Introduction

In the realm of global financial transactions, the ISO 20022 messaging standard has emerged as a cornerstone for harmonizing payment processes across banks, financial institutions, and payment systems. At the heart of these messages lies the intricate web of agents and parties responsible for ensuring seamless communication, processing, and settlement of payments. Whether it’s a simple domestic transfer or a complex cross-border transaction, understanding the roles of these agents—such as Debtor Agents, Creditor Agents, Intermediary Agents, and Reimbursement Agents—is critical for financial professionals. These agents not only facilitate the movement of funds but also uphold the integrity, traceability, and efficiency of the payment chain. This article delves into the key agents involved in ISO 20022 payment messages, explaining their responsibilities and interactions in detail.

Ultimate Debtor

The Ultimate Debtor (UltmtDbtr) is an optional party in ISO 20022 payment messages, such as PACS.008 (FI-to-FI Customer Credit Transfer). It refers to the original party responsible for the obligation to pay, distinct from the immediate Debtor in the transaction. This field is used when the payment is made on behalf of another entity or individual.

CBPR+ premise is that an Ultimate Debtor has no financial regulated direct account relationship with the corresponding Debtor.

Key Characteristics of Ultimate Debtor

- Distinct from Debtor:

- The Ultimate Debtor is the entity with the original obligation to pay, while the Debtor is the immediate party making the payment.

- Transparency:

- This field provides clarity about the payment’s origin, especially in complex payment chains or when intermediaries are involved. It is particularly useful in regulatory compliance, reconciliation, and reporting.

- Optional:

- The Ultimate Debtor is not a mandatory element in payment messages and is only used when relevant.

- Usage Contexts:

- Payments by agents, trustees, or subsidiaries.

- Scenarios where the actual obligation lies with a different party than the one initiating the payment.

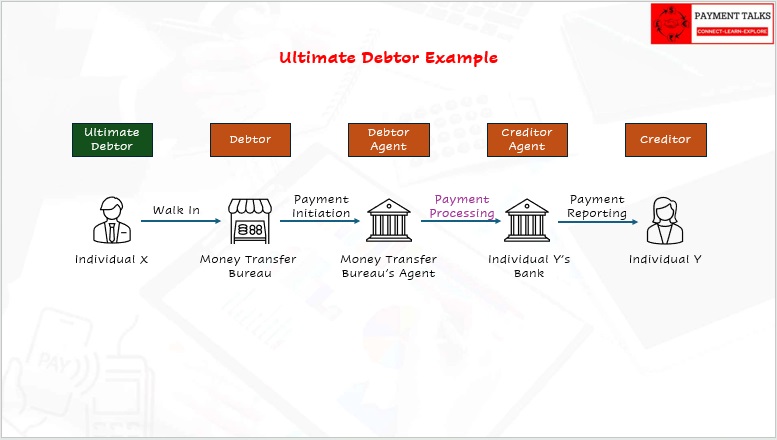

Example:

An individual X walks into a Money Transfer Bureau with relevant Private Identification (e.g. a passport) and requests a payment to be paid on their behalf to an Individual Y with Account in a Bank. Having accepted payment for the transaction, the Money Transfer Bureau executes a payment initiation request to their Agent (Bank). Bureau’s Bank is supposed to process the payment to Individual Y’ Bank. Individual Y’s Bank will report Individual Y on the funds received in her account.

Ultimate Debtor: Individual X

Debtor: Money Transfer Bureau (Also can be Initiating Party in this scenario)

Debtor Agent: Money Transfer Bureau’s Agent

Creditor Agent: Individual Y’s Bank

Creditor: Individual

In summary, the Ultimate Debtor enhances clarity and transparency in payment transactions by identifying the party that originally owes the funds, distinct from the party that executes the payment. This concept is particularly relevant in complex financial ecosystems involving intermediaries, agents, or hierarchical organizations.

Debtor

The Debtor (Dbtr) in ISO 20022 payment messages is the party responsible for initiating and making the payment. This is typically the entity (individual, organization, or corporate customer) that owes the payment amount and instructs their financial institution to transfer funds to the creditor (beneficiary).

Key Characteristics of the Debtor

- Primary Payer:

- The Debtor is the direct party responsible for initiating the payment process.

- This party is distinct from the Ultimate Debtor, which represents the original party responsible for the underlying obligation (if applicable).

- Linked to the Debtor Agent:

- The Debtor’s payment instruction is sent to the Debtor Agent (their financial institution), which facilitates the transfer of funds.

- Mandatory Field:

- In ISO 20022 messages, the Debtor is a mandatory element when the payment involves a customer (e.g., in PACS.008 messages).

Example:

Refer to the other examples for more clarity on Debtor.

The Debtor (Dbtr) is the primary party responsible for initiating and funding a payment transaction. Its role is pivotal in ensuring accurate payment processing, regulatory compliance, and clear communication between financial institutions.

Initiating Party:

The Initiating Party (InitgPty) in ISO 20022 payment messages is the entity that initiates the payment instruction. This party is often responsible for creating and submitting the payment request to the first financial institution in the payment chain (usually the Debtor Agent).

The Initiating Party has authority to initiate payment on behalf of the Debtor.

Key Characteristics of the Initiating Party

- Initiator of the Payment Process:

- This is the party that originates the payment transaction.

- It can act on behalf of another party, such as the Debtor, or initiate the payment in its own capacity.

- Distinct from the Debtor:

- The Initiating Party may not always be the Debtor.

- For example, a payment service provider or parent company might initiate the payment on behalf of another entity.

- Optional Field:

- In ISO 20022 messages, the Initiating Party is not always mandatory but can be included for additional transparency, especially in third-party payment arrangements.

- Transparency and Audit:

- Including the Initiating Party helps ensure clarity and traceability in complex or layered payment processes.

Note: When Initiating Party is different from Debtor it does not involve in Payment Settlement Process.

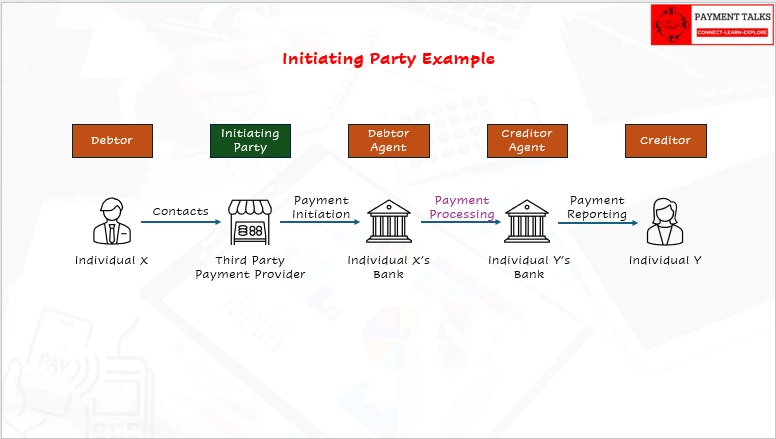

Example:

An individual X contacts a Third-Party Payment Service Provider with relevant Private Identification (e.g. a passport) and requests to initiate a payment to be paid on their behalf to an Individual Y with Account in a Bank. This Third-Party Payment Service Provider initiates a Payment to Individual X’s Bank where the Debit Account is Individual X’s account, which is held in an Individual X’s Bank. Individual X’s Bank is supposed to process the payment to Individual Y’ Bank. Individual Y’s Bank will report Individual Y on the funds received in her account.

Debtor: Individual X, as his account in Bank is the source of funds for the payment. In Previous example of Ultimate Debtor, there was no involvement of the Individual X’s Account.

Initiating Party: Third Party Payment Provider. This provider is not involved in the Payment Funds movement. It is just initiating a payment on behalf of Debtor. This Provider needs to have Debit Authority to initiate the payment from Individual X’s Account and this information should be communicated already to Individual X’s Bank for smooth processing.

Debtor Agent: Individual X’s Bank

Creditor Agent: Individual Y’s Bank

Creditor: Individual Y

The Initiating Party (InitgPty) is the entity responsible for initiating the payment transaction in ISO 20022 messages. While not always the payer (Debtor), the Initiating Party plays a crucial role in ensuring transparency, compliance, and efficient payment processing, especially in cases involving intermediaries or third parties.

Forwarding Agent

In the context of the PAIN.001 message (Customer Credit Transfer Initiation), the Forwarding Agent refers to a financial institution that relays the payment instruction from the initiating party/debtor to the debtor’s financial institution (Debtor Agent). The Forwarding Agent typically operates as a concentrating financial institution, facilitating the transmission of the payment message within the payment processing chain. This is commonly known as a relay scenario.

Note:

Forwarding Agent should have Debit Authority over the Debtor’s Account. This is usually handled by Tripartite Agreements.

Forwarding Agent is performing a technical role in the payment transaction. They would not be represented in the payment, clearing and settlement. Thus, this information is not passed on in the PACS messages.

Key Characteristics of a Forwarding Agent in PAIN.001

- Intermediary Financial Institution:

- It serves as a bridge between the Initiating Party (e.g., a corporate entity or individual) and the Debtor Agent (e.g., the payer’s bank).

- Optional Role:

- The Forwarding Agent is not a mandatory element in PAIN.001 messages and is used only in scenarios where an intermediary financial institution is involved in forwarding the payment instruction.

- Part of the Payment Chain:

- The Forwarding Agent facilitates the routing of the payment initiation message, ensuring it reaches the appropriate Debtor Agent for further processing.

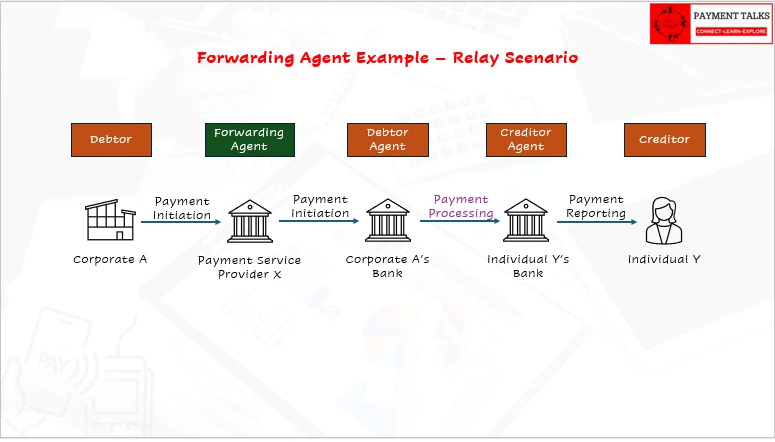

Example:

Relay Scenario: Corporate A sends a payment initiation message to “Payment Service Provider X”. The Payment Service Provider then forwards this payment to a Bank which holds the account of the Corporate A. This Payment is then processed to Individual Y’s Bank and Funds credit is reported to Individual Y.

Initiating Party/Debtor: Corporate A, as its account is the Source of Initial Funds. Corporate A can also be called Initiating Party as it is initiating the Payment. Since it is already represented in Debtor, there is no need to represent again in the Initiating Party.

Forwarding Agent: Payment Service Provider X. It is just Relaying the Payment Initiation to the Debtor Agent. This Provider X should have Debit Authority over Corporate A’s Account and this information should be communicated to Corporate A’s Bank for Smooth Processing.

Debtor Agent: Corporate A’s bank

Creditor Agent: Individual Y’s Bank

Creditor: Individual Y

The Forwarding Agent (FwdgAgt) in a PAIN.001 message is a financial institution that relays the payment initiation instruction from the Initiating Party to the Debtor Agent. While optional, it plays a critical role in complex payment chains, ensuring seamless routing and compliance with regulatory and operational requirements.

Debtor Agent

The Debtor Agent (DbtrAgt) in ISO 20022 payment messages is the financial institution responsible for servicing the account of the Debtor (payer). This agent facilitates the debit of the Debtor’s account and the transmission of the payment funds to the next party in the payment chain.

Key Characteristics of the Debtor Agent

- Account Servicing Institution:

- The Debtor Agent manages the Debtor’s account from which the payment funds are debited.

- Intermediary Role in Payment Flow:

- It acts as a mediator between the Debtor and the payment chain, ensuring the transfer of funds to the creditor or intermediary agents.

- Responsible for Payment Execution:

- The Debtor Agent processes the payment based on instructions provided by the Debtor or an authorized Initiating Party.

- Mandatory Field:

- In most ISO 20022 messages, including PACS.008 and PAIN.001, the Debtor Agent is a required element.

- In PACS.009, the Debtor Agent is optional field as the Debtor itself is a financial institution.

Example:

Refer to the Earlier examples for more clarity on Debtor Agent.

The Debtor Agent (DbtrAgt) is a crucial entity in ISO payments, serving as the financial institution responsible for debiting the Debtor’s account and initiating the payment transfer. Its role ensures proper execution, compliance, and traceability, making it a cornerstone of secure and efficient payment processing.

Creditor Agent

The Creditor Agent (CdtrAgt) in ISO 20022 payment messages is the financial institution that services the account of the Creditor (beneficiary). It is responsible for receiving the payment funds on behalf of the Creditor and crediting the funds to their account.

Key Characteristics of the Creditor Agent

- Account Servicing Institution:

- The Creditor Agent manages the Creditor’s account and ensures that the funds are credited to the appropriate account.

- Receives Payment from the Previous Agent:

- It receives the payment from the Debtor Agent directly or through one or more Intermediary Agents.

- Final Step in the Payment Chain:

- The Creditor Agent is usually the last financial institution in the payment process before the funds are delivered to the Creditor. (In PACS.009, Creditor is also a financial institution)

- Mandatory Field:

- In most ISO 20022 messages, including PACS.008 and PAIN.001, the Creditor Agent is a required element.

- In PACS.009, the Creditor Agent is optional field as the Creditor itself is a financial institution.

Example:

Refer to the Earlier examples for more clarity on Creditor Agent.

The Creditor Agent (CdtrAgt) is the financial institution responsible for the final step of the payment process—crediting the funds to the Creditor’s account. Its role is pivotal for the successful completion of any payment transaction, ensuring accuracy, compliance, and a seamless flow of funds.

Creditor

The Creditor (Cdtr) in ISO 20022 payment messages is the party who is the beneficiary of the payment funds. It is the entity (person, business, or organization) that is meant to receive the payment and whose account is credited by the Creditor Agent.

Key Characteristics of the Creditor

- Payment Beneficiary:

- The Creditor is the party for whom the payment is intended, and they are the final recipient of the funds in the payment chain.

- Identified by Account Details:

- The Creditor is identified by their account information, such as an IBAN (International Bank Account Number) or other account identifiers.

- Direct Relationship with the Creditor Agent:

- The Creditor’s account is typically held with the Creditor Agent, which ensures the payment is credited to the Creditor.

- Mandatory Element:

- The Creditor field is required in ISO 20022 payment messages like PACS.008 (FI to FI Credit Transfer) and PAIN.001 (Customer Credit Transfer Initiation).

Example :

Refer to the Earlier examples for more clarity on Creditor.

The Creditor (Cdtr) is a fundamental role in ISO payments, representing the party for whom the payment is intended. Precise identification of the Creditor ensures smooth payment processing, regulatory compliance, and successful delivery of funds to the intended beneficiary.

Ultimate Creditor

The Ultimate Creditor (UltmtCdtr) in ISO 20022 payment messages is the final party who is the actual beneficiary of the funds, even if it differs from the Creditor. It represents the true recipient of the payment in cases where the funds are credited to an intermediary or proxy account before reaching the final beneficiary.

Note: CBPR+ premise is that an Ultimate Creditor has no financial regulated direct account relationship with the corresponding Creditor.

Key Characteristics of the Ultimate Creditor

- True Beneficiary of Funds:

- The Ultimate Creditor is the entity (person or organization) that ultimately benefits from the payment, regardless of the account initially credited.

- Different from the Creditor (Optional):

- While often the Creditor and Ultimate Creditor are the same, they can differ in complex payment arrangements, such as when a payment is routed through a proxy or intermediary.

- Optional Field:

- The Ultimate Creditor is an optional element in ISO 20022 messages. It is included only when the true beneficiary differs from the directly credited party (Creditor).

- Ensures Payment Transparency:

- Provides additional detail in the payment chain, enhancing clarity and regulatory compliance.

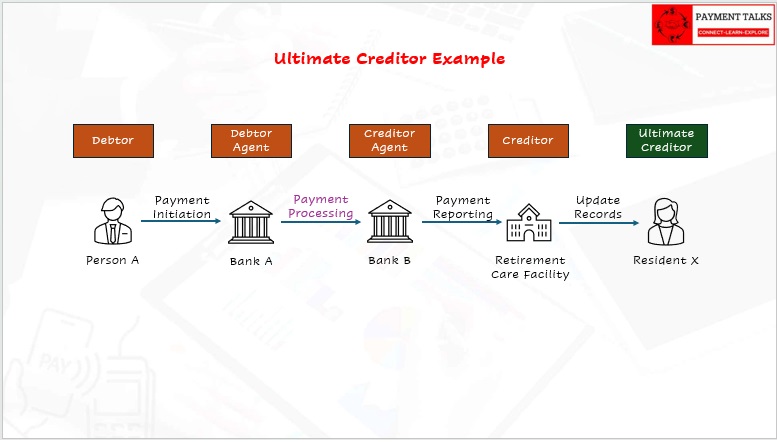

Example:

Person A initiates a payment via his Bank A to a retirement care facility to pay the fees of one of its residents named X. Bank A processes the payment to Bank B which holds the account of the Retirement Care Facility. Bank B reports the credit of Funds to Retirement Facility and Retirement Facility updates its record of the Payment for Resident X.

Debtor: Person A

Debtor Agent: Bank A

Creditor Agent: Bank B

Ultimate Creditor: Resident X, as he/she is the Actual beneficiary of the services the fee is paying for.Creditor: Retirement Care Facility, as its account receives the Amount.

The Ultimate Creditor (UltmtCdtr) is the actual beneficiary of a payment in cases where the Creditor acts as an intermediary or proxy. While optional, including the Ultimate Creditor enhances transparency, regulatory compliance, and accuracy in payment processing, ensuring the funds reach the intended recipient in complex payment scenarios.

Instructing Agent

The Instructing Agent (InstgAgt) in ISO 20022 payment messages refers to the financial institution that sends the payment instruction to the next party in the payment chain. It acts as the sender of a payment message, relaying the instructions to the next intermediary or to the recipient’s financial institution.

Note: Instructing Agent Role is Dynamic in Nature where it holds different Financial Institution information throughout the Payment Chain.

Key Characteristics of the Instructing Agent

- Sender of the Payment Instruction:

- The Instructing Agent is responsible for initiating and transmitting a payment message to the next agent in the chain.

- Intermediary Role:

- It can be the Debtor Agent, an Intermediary Agent, or any other financial institution involved in the payment process.

- Message Originator:

- It is identified as the sender of the message in the specific payment chain step.

- Mandatory Field in Payment Chains:

- The Instructing Agent is essential for tracing the source of the payment instruction and maintaining accountability.

The Instructing Agent (InstgAgt) plays a crucial role in ISO 20022 payments by acting as the sender of payment instructions within the chain. It ensures the smooth, secure, and traceable flow of transactions between financial institutions, contributing to the overall efficiency and reliability of payment systems.

Instructed Agent

The Instructed Agent (InstdAgt) in ISO 20022 payment messages refers to the financial institution that receives a payment instruction from the Instructing Agent. It acts as the recipient of the message and is responsible for taking the next step in the payment chain based on the received instructions.

Note: Instructed Agent Role is Dynamic in Nature where it holds different Financial Institution information throughout the Payment Chain.

Key Characteristics of the Instructed Agent

- Receiver of the Payment Instruction:

- The Instructed Agent is the financial institution that receives the payment message from the preceding institution (Instructing Agent).

- Performs the Next Action:

- The Instructed Agent processes the payment according to the received instructions, which might include crediting the funds, forwarding the payment, or conducting compliance checks.

- Any Agent in the Chain:

- It can be the Creditor Agent, an Intermediary Agent, or another financial institution, depending on the step in the payment process.

- Mandatory Field in Payment Chains:

- The Instructed Agent field ensures traceability and accountability at every step of the transaction.

The Instructed Agent (InstdAgt) plays a vital role in ISO 20022 payments as the recipient of payment instructions in the transaction chain. Its ability to process instructions accurately ensures the efficient flow of funds, compliance with regulatory standards, and successful execution of the payment.

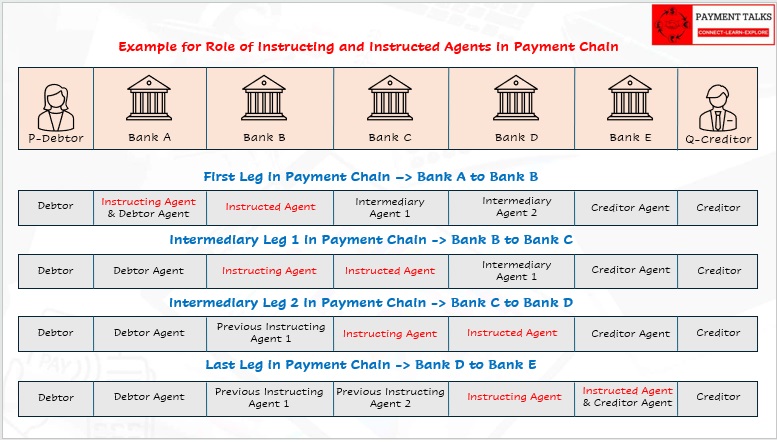

Example for Dynamic Roles of Instructing and Instructed Agents

A person P is initiating a payment to another Person Q. P’s Bank is A. Q’s Bank is E. There are three Intermediary Banks namely B, C, D via whom the payment will be processed from Bank A to Bank E. For the Payment to get completed, there are Four Legs.

- First Leg: Bank A processing Payment to Bank B.

- Intermediary Leg 1: Bank B processing payment to Bank C.

- Intermediary Leg 2: Bank C processing Payment to Bank D.

- Final Leg: Bank D processing payment to Bank E.

In this Example, we focus only on Instructing and Instructed Agents.

- In the First Leg Chain, Bank A, though it is Debtor Agent, it is also the Instructing Agent of the Payment. Bank B which is the First Intermediary Bank in the Chain is now Instructed Agent.

- In the Intermediary Leg 1 Chain, Bank B which was Instructed agent in the previous chain now became the Instructing agent. Bank C which was one of the Intermediary Agents in the Original Payment Chain has now become the Instructed Agent.

- In the Intermediary Leg 2 Chain, Bank C which was Instructed agent in the previous chain now became the Instructing agent. Bank D which was one of the Intermediary Agents in the Original Payment Chain has now become the Instructed Agent.

- In the Final Leg Chain, Bank D which was Instructed agent in the previous chain now became the Instructing agent. Bank E which was Creditor Agent all the while will still be a Creditor Agent but also in this Final Leg it is Instructed Agent as well.

Note: Bank A and Bank E which were Debtor Agent and Creditor Agent will remain as same throughout the Payment Life Cycle. This confirms the Static Role of Debtor Agent and Creditor Agent who hold the Accounts of Debtor and Creditor respectively.

Previous Instructing Agents

The Previous Instructing Agent(s) (PrvsInstgAgt) in ISO 20022 payment messages refers to the financial institution(s) that have already processed and forwarded the payment instruction before it reaches the current Instructing Agent. These agents form part of the chain of institutions responsible for relaying the payment message.

Industry Best Practice Tip: Previous Instructing Agent Fields should only be used when any Financial Institution does not have position in Debtor Agent or Instructing Agent.

Key Characteristics of Previous Instructing Agents

- Intermediary Institutions:

- These are financial institutions that handled the payment instruction earlier in the payment process.

- Sequential Role:

- Each Previous Instructing Agent precedes the current Instructing Agent in the chain. The “previous” designation is relative to the perspective of the message sender.

- Multiple Agents Possible:

- There can be one or more Previous Instructing Agents, depending on the complexity of the payment chain.

- Optional Field:

- While not always mandatory, including Previous Instructing Agents enhances traceability and transparency of the payment process.

- Static Roles:

- Previous Instructing Agent is a static role which allows additional Previous Instructing Agent to be appended to the history of the payment.

- Once occupied they will not change their position throughout the life cycle of the payment.

Types of Previous Instructing Agents

- Previous Instructing Agent 1 (PrvsInstgAgt1):

- This is the first historic financial institution between the Debtor Agent and the Instructing Agent or Previous Instructing Agent 2 (if present).

- Previous Instructing Agent 2 (PrvsInstgAgt2):

- This is the second historic financial institution between the Previous Instructing Agent 1 and the Instructing Agent or Previous Instructing Agent 3 (if present).

- Previous Instructing Agent 3 (PrvsInstgAgt3):

- This is the latest historic financial institution between the Previous Instructing Agent 2 and the Instructing Agent.

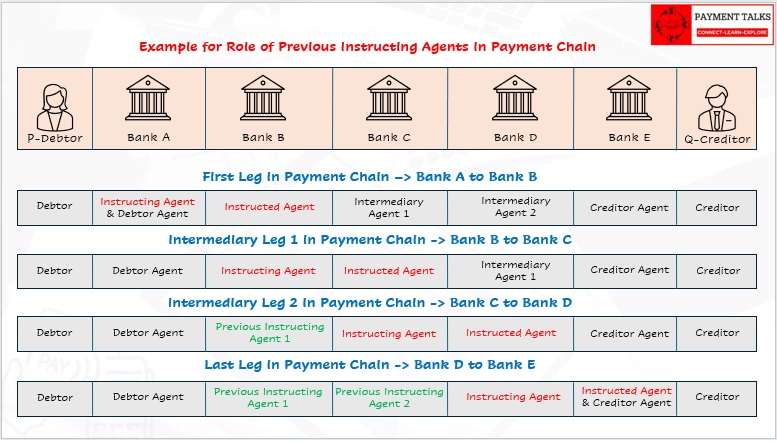

Example:

A person P is initiating a payment to another Person Q. P’s Bank is A. Q’s Bank is E. There are three Intermediary Banks namely B, C, D via whom the payment will be processed from Bank A to Bank E. For the Payment to get completed, there are Four Legs.

- First Leg: Bank A processing Payment to Bank B.

- Intermediary Leg 1: Bank B processing payment to Bank C.

- Intermediary Leg 2: Bank C processing Payment to Bank D.

- Final Leg: Bank D processing payment to Bank E.

In this Example, we focus only on Previous Instructing Agents.

- In the First Leg, there are no Previous Instructing Agents as Payment journey just started and there are no financial institutions where the payment has already passed.

- In the Intermediary Leg 1 Chain, Payment has passed Bank A. This is in a way Previous Instructing Agent for Bank B in this payment Leg. But Since Bank A has its position in the Debtor Agent Field, we should not populate Bank A information in the Previous Instructing Agent.

- In the Intermediary Leg 2 Chain, Payment has passed Bank A and Bank B. These two banks are in a way Previous Instructing Agents for Bank C in this payment Leg. As explained, Bank A has its position in the Debtor Agent Field, so we should not populate Bank A information in the Previous Instructing Agent. Now Bank B does not have any position in Debtor Agent or Instructing Agent in this Leg. So, Bank B details will be mentioned in the Previous Instructing Agent 1 field.

- In the Final Leg Chain, Payment has passed Bank A, Bank B and Bank C. These three banks are in a way Previous Instructing Agents for Bank D in this payment Leg. As explained, Bank A has its position in the Debtor Agent Field, so we should not populate Bank A information in the Previous Instructing Agent. Bank B is populated in the Previous Instructing Agent 1 field. Since the Role is Static in Nature, Bank B still will be Previous Instructing Agent 1. Bank C will now be mentioned in the Previous Instructing Agent 2 Field.

The Previous Instructing Agent(s) (PrvsInstgAgt) play a vital role in tracking the flow of payment instructions across financial institutions in ISO 20022 payments. Their inclusion ensures transparency, operational clarity, and compliance, making them critical for secure and efficient payment processing in complex payment chains.

Intermediary Agents

Intermediary Agents (IntrmyAgt) in ISO 20022 payment messages are financial institutions that facilitate the transfer of payment instructions and funds between the Debtor Agent (payer’s bank) and the Creditor Agent (payee’s bank). These agents are essential in the payment process when there is no direct relationship between the Debtor Agent and Creditor Agent.

Industry Best Practice Tip: Intermediary Agent Fields should only be used when any Financial Institution does not have position in Instructed Agent or Creditor Agent.

Key Characteristics of Intermediary Agents

- Facilitates Payment Transfer:

- They ensure the smooth transfer of payment instructions and funds between financial institutions that do not have direct correspondent banking relationships.

- Multiple Intermediaries Possible:

- Depending on the payment chain, one or more intermediary agents may be involved.

- Optional Fields:

- Including intermediary agents is not mandatory unless required by the payment routing or settlement process.

- Dynamic Roles:

- Intermediary Agent is a dynamic role where the agents are classified in numeric order to differentiate their role in each payment leg.

- The agents occupying these roles change throughout the life cycle of the payment.

Types of Intermediary Agents

- Intermediary Agent 1 (IntrmyAgt1):

- The first financial institution in the intermediary chain between Debtor Agent and Creditor Agent for who the Instructed Agent attempt to instruct the payment on to next agent.

- Intermediary Agent 2 (IntrmyAgt2):

- A subsequent financial institution in the chain, receiving the payment instruction from Intermediary Agent 1.

- This is the second Intermediary Agent between Intermediary Agent 1 and the Creditor Agent or Intermediary Agent 3.

- Intermediary Agent 3 (IntrmyAgt3):

- Another intermediary in the chain, forwarding the payment instruction closer to the Creditor Agent.

- This is the Third Intermediary Agent between Intermediary Agent 2 and the Creditor Agent.

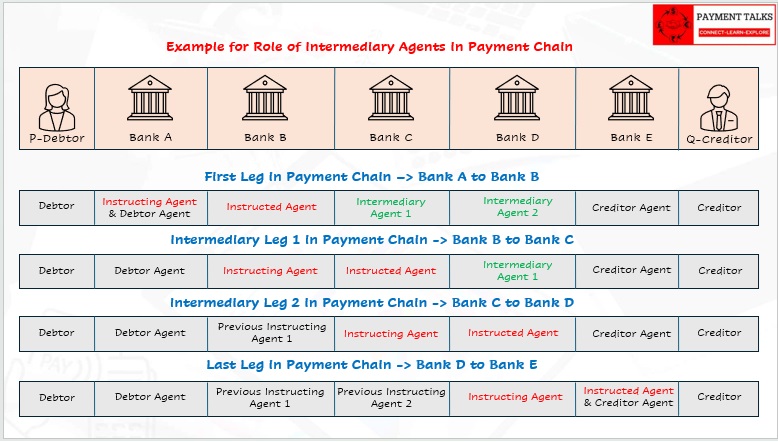

Example:

A person P is initiating a payment to another Person Q. P’s Bank is A. Q’s Bank is E. There are three Intermediary Banks namely B, C, D via whom the payment will be processed from Bank A to Bank E. For the Payment to get completed, there are Four Legs.

- First Leg: Bank A processing Payment to Bank B.

- Intermediary Leg 1: Bank B processing payment to Bank C.

- Intermediary Leg 2: Bank C processing Payment to Bank D.

- Final Leg: Bank D processing payment to Bank E.

In this Example, we focus only on Intermediary Agents.

- In the First Leg, Bank A Instructing Agent is sending to Bank B Instructed Agent. There are 2 banks, Bank C and Bank D, before reaching the Creditor Agent Bank E. These two banks occupy the Fields Intermediary Agents 1 and 2 respectively. Bank C occupies the Field Intermediary Agent 1, indicating that it is the Next Bank in Chain after the Instructed Agent Bank B. Here 1 symbolises the next immediate agent. Bank D occupies the Field Intermediary Agent 2, indicating that it is the next bank in chain after Intermediary Agent 1 Bank C. Bank E is Creditor Agent, and it should not be considered as Intermediary Agent.

- In the Intermediary Leg 1 Chain, Bank B Instructing Agent is sending to Bank C Instructed Agent. There is only 1 bank, Bank D, before reaching the Creditor Agent Bank E. Bank D occupies the Field Intermediary Agent 1, indicating that it is the Next Bank in Chain after the Instructed Agent Bank C. Here 1 symbolises the next immediate agent. Notice that as Bank C moved to Instructed Agent, Bank D moves to Intermediary Agent 1. Bank E is Creditor Agent, and it should not be considered as Intermediary Agent.

- In the Intermediary Leg 2 Chain, Bank C Instructing Agent is sending to Bank D Instructed Agent. There are no Banks between the Instructed Agent Bank D and Creditor Agent Bank E. So, there is no need to fill the Intermediary Agent Fields.

- In the Final Leg Chain, Bank D Instructing Agent is sending to Bank E Instructed Agent and also Creditor Agent. As this is the Final Leg, there is no need of any Intermediary Agents.

Intermediary Agents (IntrmyAgt) are essential for processing payments in situations where the Debtor Agent and Creditor Agent lack a direct relationship. By facilitating the transfer of funds and instructions through one or more financial institutions, they ensure seamless payment routing, enhance traceability, and support the global payments ecosystem.

Reimbursement Agents

In ISO 20022 payment messages, Reimbursement Agents are financial institutions involved in the settlement of funds between the Debtor Agent and Creditor Agent. They act as intermediaries to facilitate the transfer of funds from the payer’s bank to the payee’s bank, particularly in scenarios involving cover payment scenarios using correspondent banking relationships or payment clearing systems.

Key Characteristics of Reimbursement Agents

- Role in Settlement:

- These agents ensure the actual transfer of funds between banks especially in Cover Scenarios, often using correspondent accounts or clearing systems.

- Used in Indirect Relationships:

- Reimbursement Agents are typically involved when the Debtor Agent and Creditor Agent do not have a direct banking relationship. But they do have RMA relationship to exchange Direct or Announcement message.

- Optional Fields:

- Inclusion of these agents in a payment message depends on the complexity of the settlement arrangement like in Cover Scenarios.

Types of Reimbursement Agents

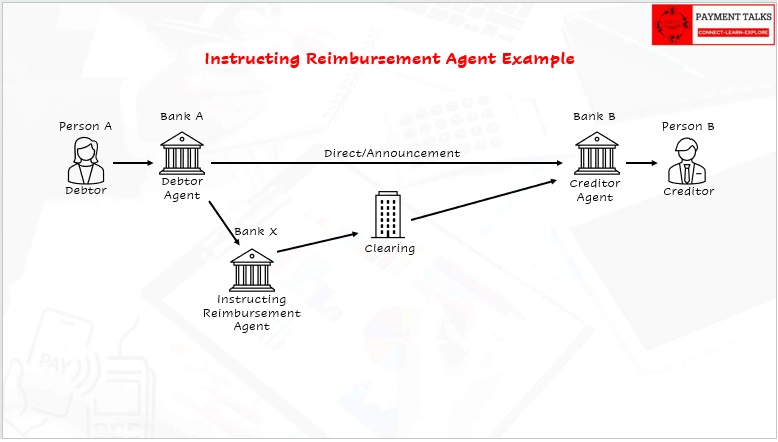

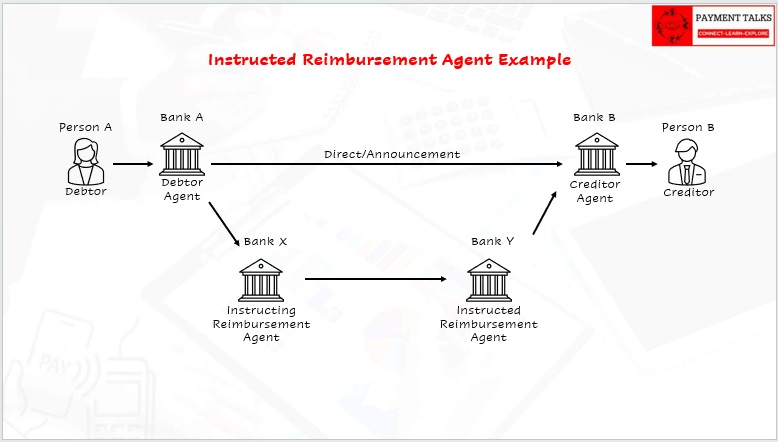

- Instructing Reimbursement Agent (InstgRmbrsmntAgt):

- The first financial institution in the reimbursement chain that receives the covering payment or settlement instruction from the Debtor Agent.

- It initiates the transfer of funds.

- It is the agent who will execute a covering payment and often referred to as the Currency Correspondent.

Example:

- Person A, using his Bank A, wants to send the funds to Person B, who is having his account with Bank B.

- Bank A and Bank B does not have Accounting Relationship in the Currency of the Payment. But they have RMA relationship to exchange the Direct or Announcement Message.

- Bank A uses his Currency Correspondent Bank X to settle the payment to Bank B.

- Bank X uses the Domestic Clearing to settle the funds in that currency. Finally Bank B informs the Person B of the receipt of the funds.

This is one of the use cases where only One Reimbursement Agent is used for the Settlement.

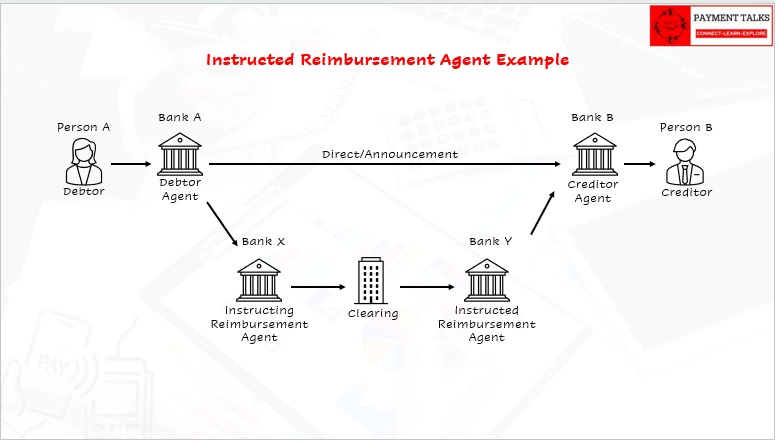

- Instructed Reimbursement Agent (InstdRmbrsmntAgt):

- The financial institution in the reimbursement chain that receives the covering payment or settlement instruction from Instructing Reimbursement Agent directly or via clearing.

- It receives the funds and credits the account.

- It is the second agent after Instructing Reimbursement Agent in the payment settlement chain.

Example:

- Person A, using his Bank A, wants to send the funds to Person B, who is having his account with Bank B.

- Bank A and Bank B does not have Accounting Relationship in the Currency of the Payment. But they have RMA relationship to exchange the Direct or Announcement Message.

- Bank A identifies the Reimbursement Chain as Bank X as their Correspondent and Bank Y as Bank B’s Correspondent.

We will discuss in detail the method and process to build a chain in the later videos.

The Payment is now settled via the Reimbursement Chain using Bank X and Bank Y.

Sometimes, Bank X and Bank Y may not have Accounting Relationship directly, but they may be connected to a Local Clearing System to settle funds for that currency.

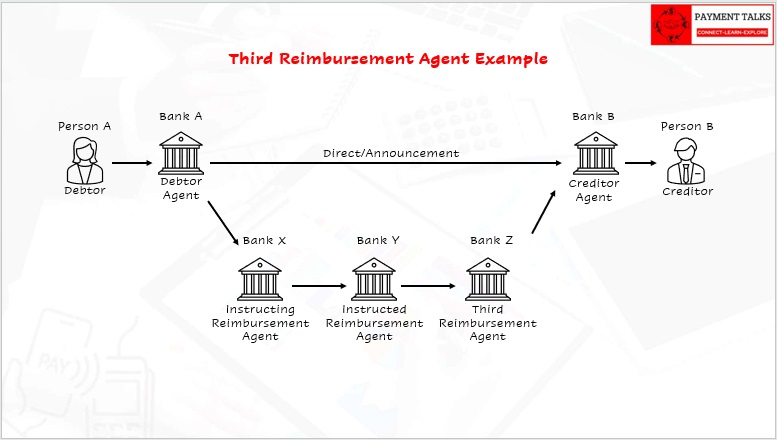

- Third Reimbursement Agent (ThrdRmbrsmntAgt):

- The final financial institution in the reimbursement chain that transfers funds to the Creditor Agent.

- It receives the covering payment or settlement instruction from Instructed Reimbursement Agent.

- It is an additional agent who will receive the covering payment where this is not the agent detailed in the Instructed Reimbursement Agent.

Example:

- Person A, using his Bank A, wants to send the funds to Person B, who is having his account with Bank B.

- Bank A and Bank B does not have Accounting Relationship in the Currency of the Payment. But they have RMA relationship to exchange the Direct or Announcement Message.

- Bank A identifies the Reimbursement Chain as Bank X as their Correspondent and Bank Z as Bank B’s Correspondent with an additional Reimbursement Agent Bank Y between Bank X and Bank Z.

We will discuss in detail the method and process to build a chain in the later videos.

The Payment is now settled via the Reimbursement Chain using Bank X, Bank Y and Bank Z.

Reimbursement Agents, including the Instructing, Instructed, and Third Reimbursement Agents, are critical for ensuring the successful settlement of funds in ISO 20022 payments. Their roles provide essential infrastructure for indirect relationships, enhance the transparency of payment chains, and enable smooth processing in complex or cross-border transactions.

Additional Information

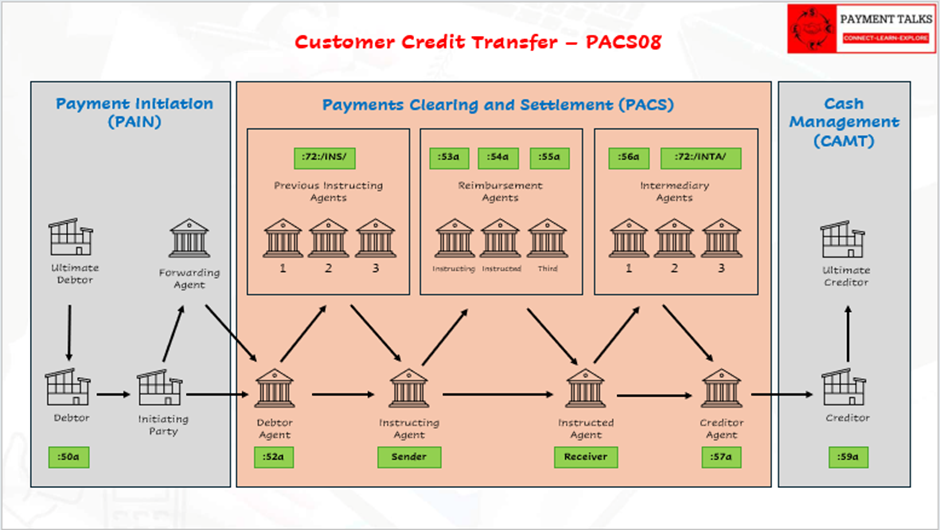

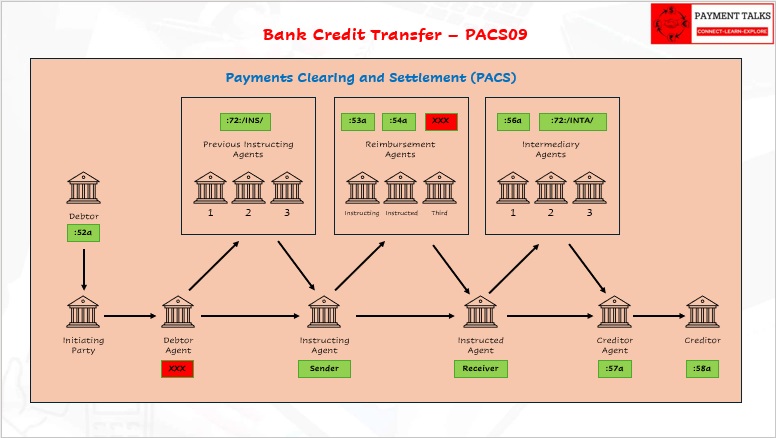

Comparison of the Agents in Customer Credit Transfer PACS08 vs Bank Credit Transfer PACS09 on high level for more clarity. This is just for simplifying the concept.

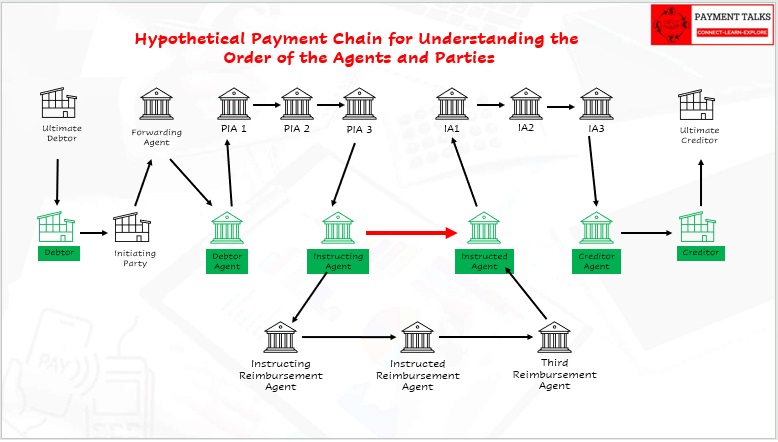

Hypothetical Payment Chain to understand the order of the Agents and Parties relative to the Bank where Payment Engine will be present. This is to simply the concept while deriving the Debit Account and Credit Account in the payment.

Conclusion

The ISO 20022 standard’s ability to clearly define the roles of various agents in payment messages ensures greater transparency, efficiency, and interoperability in the global payments ecosystem. Each agent—from the Ultimate Debtor to the Ultimate Creditor, and every intermediary in between—plays a distinct and vital role in facilitating the smooth flow of funds. By understanding these roles and their hierarchical relationships, financial institutions and professionals can better navigate the complexities of payment processing, enhance compliance with regulatory requirements, and deliver superior services to their clients. As the world continues to embrace ISO 20022, mastering the functions of these agents becomes indispensable for driving innovation and reliability in payments.