Introduction

In the realm of international banking, correspondent banking plays a pivotal role in enabling cross-border transactions and financial settlements. Correspondent banking is a system where banks establish relationships with one another to provide services in regions where they lack direct presence. To facilitate these relationships, banks use specialized accounts such as Nostro, Vostro, Mirror Nostro, and Loro Accounts. These accounts serve as the foundation for managing foreign currency transactions, reconciling balances, and ensuring smooth payment processing across different countries and currencies.

Each of these accounts represents a specific relationship and function within the correspondent banking framework, allowing banks to settle payments, hold foreign currency balances, and process international trade transactions efficiently. This article explores the concepts of Nostro, Vostro, Mirror Nostro, and Loro Accounts in detail, explains their interrelations, and provides practical examples with accounting entries to illustrate their roles in payment processing. Whether you’re navigating the complexities of banking or simply curious about global financial systems, this guide will offer a clear and insightful explanation of these essential tools in international banking.

Key Features and Functions

Vostro Account

A Vostro account (from the Latin word vostro, meaning “yours”) is an account that a foreign correspondent bank maintains with a domestic bank, denominated in the domestic currency. From the perspective of the domestic bank, it is “your account with us,” referring to the foreign bank’s funds held in the domestic bank’s books.

Vostro accounts play a critical role in correspondent banking, enabling foreign banks to manage their operations in the domestic bank’s jurisdiction without the need for a physical presence.

Purpose of a Vostro Account

Vostro accounts are essential for facilitating cross-border banking services. They serve several purposes, including:

- Domestic Payments for Foreign Banks: Allowing foreign banks to process transactions in the domestic currency.

- Collection and Remittance: Enabling the correspondent bank to collect funds and transfer payments on behalf of its customers.

- Trade Settlements: Supporting international trade by facilitating payments for imports and exports.

- Liquidity Management: Helping foreign banks maintain reserves in the domestic currency for ongoing transactions.

Key Characteristics of a Vostro Account

- Currency Denomination: Always denominated in the domestic currency of the bank holding the account.

- Liability in the Books: From the domestic bank’s perspective, a Vostro account represents a liability, as the funds belong to the foreign bank.

- Facilitates Local Transactions: Acts as an operational tool for the foreign bank to process transactions in the domestic market.

- Support for Correspondent Relationships: Reflects the foreign bank’s reliance on the domestic bank for services in the local jurisdiction.

Nostro Account

In the context of correspondent banking, a Nostro account (derived from the Latin word nostro, meaning “ours”) is an account that a bank maintains with a correspondent bank in a foreign country, denominated in the currency of that foreign country. It allows a bank to conduct transactions in foreign currencies by leveraging the correspondent bank’s infrastructure.

From the perspective of the bank maintaining the account, it is referred to as a Nostro account, while for the correspondent bank holding the funds, the same account is viewed as a Vostro account

Purpose of a Nostro Account

Nostro accounts play a crucial role in facilitating cross-border transactions. Some of the primary purposes include:

- Foreign Trade Payments: Settling payments for imports and exports between countries.

- Foreign Currency Holdings: Managing liquidity in foreign currencies for transactions or hedging purposes.

- Cross-Border Remittances: Enabling the transfer of funds internationally.

- Efficient Settlement: Avoiding the need for physical movement of currency by using digital records at correspondent banks.

Key Characteristics of a Nostro Account

- Currency Denomination: Always denominated in the currency of the correspondent bank’s country.

- Asset in the Books: A Nostro account is an asset in the books of the domestic bank, as it represents funds deposited with the foreign correspondent bank.

- Cross-Border Settlements: Used to settle international transactions efficiently without requiring a physical presence in the foreign country.

- Tracked by Mirror Nostro: The domestic bank typically maintains a Mirror Nostro account to track transactions in the Nostro account.

Mirror Nostro Account

A Mirror Nostro account is a replicated ledger maintained by a bank to monitor and reconcile the transactions and balance of its Nostro account held with a foreign correspondent bank. While the Nostro account exists in the books of the foreign bank, the Mirror Nostro account is maintained internally by the domestic bank as a reflection of the Nostro account’s activity.

The Mirror Nostro account serves as a tracking and reconciliation tool that ensures the domestic bank’s records align with the actual balance held in the foreign bank’s Nostro account.

Purpose of a Mirror Nostro Account

From an operational perspective, the primary purposes of a Mirror Nostro account include:

- Reconciliation: Ensuring that the transactions recorded in the domestic bank’s books match those reflected in the foreign bank’s Nostro account ledger.

- Real-Time Monitoring: Providing an updated view of the foreign currency balance held in the Nostro account.

- Error Detection: Identifying discrepancies or errors between the domestic and correspondent banks’ records.

- Operational Efficiency: Enabling the domestic bank to manage foreign currency liquidity effectively by tracking inflows and outflows.

- Audit Trail: Offering a detailed record of all transactions for regulatory compliance and internal audits.

Operational Setup of a Mirror Nostro Account

- Account Structure:

- The Mirror Nostro account is maintained in the domestic bank’s general ledger in the currency of the Nostro account. For example, if the Nostro account is in GBP, the Mirror Nostro account will also reflect GBP transactions.

- It acts as an off-balance-sheet account, used solely for tracking and reconciliation purposes.

- Accounting entries in Mirror Nostro Account are opposite in nature than Nostro Account. Example: A Credit in the Nostro Account is reflected as a Debit in the Mirror Nostro Account and vice versa.

- Automation:

- Banks use core banking systems to automatically update Mirror Nostro accounts whenever there is a debit or credit in the actual Nostro account.

- SWIFT messages (e.g., CAMT53 for Nostro account statements) are automatically reconciled with the Mirror Nostro account to update balances.

- Reconciliation Process:

- The domestic bank compares the Mirror Nostro account balance with the actual Nostro account balance as reported by the foreign correspondent bank.

- Any mismatches are investigated and corrected through adjustments or follow-up communications.

NOTE:

Nostro Mirror Account in the Home Currency: In some cases, a bank may also maintain a version of the Nostro Mirror Account in its home currency (e.g., USD for a US bank). This account reflects the home currency equivalent of the foreign currency balance in the Nostro Account. Primary Purpose of this mirror account is for financial reporting, risk management, or tracking the domestic currency value of foreign assets/liabilities. This is different from the Nostro Mirror Account used for Cross Border Payments where primary purpose is transaction tracking and reconciliation.

Key Characteristics of a Mirror Nostro Account

- Internal Ledger: Exists in the domestic bank’s internal records, not in the foreign correspondent bank’s books.

- Currency Match: Denominated in the same currency as the Nostro account.

- Real-Time Updates: Reflects every transaction processed in the Nostro account.

- Not a Financial Asset: Unlike the Nostro account (which is an asset), the Mirror Nostro account is purely operational and does not represent actual funds.

- Reconciliation Tool: Acts as a control mechanism to ensure accuracy in foreign account management.

Nostro Account vs. Mirror Nostro Account

| Aspect | Nostro Account | Mirror Nostro Account |

| Definition | The foreign currency account held with a correspondent bank. | An internal ledger maintained to track Nostro account transactions. |

| Location | Maintained in the foreign bank’s books. | Maintained in the domestic bank’s books. |

| Purpose | Used for actual transactions in foreign currency. | Used for reconciliation and monitoring purposes. |

| Financial Role | Represents an asset for the domestic bank. | Does not represent an actual financial asset. |

Loro Account

A Loro account (from the Latin word loro, meaning “their”) is a term used in correspondent banking to refer to an account held by a third-party bank with another bank. In simpler terms, a Loro account describes “their account with them,” and it is a way to refer to the Nostro or Vostro account of another bank from a third bank’s perspective.

- For example, if Bank A (USA) holds a GBP account (Nostro) with Bank B (UK), then Bank C (Germany) would refer to it as “their (Bank A’s) account with them (Bank B).”

Unlike Nostro or Vostro accounts, which involve a direct banking relationship, the term Loro account is used for communication and reporting purposes in a three-bank relationship.

Purpose of a Loro Account

In correspondent banking, the Loro account is not an account that exists physically in the books of any bank. Instead, it is a reference concept used to:

- Identify Third-Party Accounts: Allow banks to refer to accounts of other banks (Nostro or Vostro) when facilitating cross-border payments.

- Intermediary Role: Enable third banks to process or track payments between two other banks.

- Simplify Reporting: Facilitate communication, especially in multi-bank payment chains, where intermediaries need to describe account relationships clearly.

Key Characteristics of a Loro Account

- Third-Party Reference: It is not an actual account but a way to describe a Nostro or Vostro account of another bank.

- Used in Reporting: Often referenced in payment instructions, SWIFT messages, and operational documentation.

- Facilitates Multi-Bank Relationships: Helps banks work as intermediaries without needing direct relationships with all parties.

- Currency Neutral: The term applies regardless of the currency of the underlying account.

Comparison of Vostro, Nostro, Mirror Nostro, and Loro Accounts

| Aspect | Vostro Account | Nostro Account | Mirror Nostro Account | Loro Account |

| Meaning | “Your account with us” (a foreign bank’s account in the domestic bank’s books). | “Our account with you” (the domestic bank’s account held with a foreign correspondent bank). | A replication of the Nostro account maintained internally by the domestic bank for reconciliation. | “Their account with them” (a third-party bank’s reference to another bank’s account). |

| Purpose | To allow a foreign bank to manage transactions in the domestic bank’s currency. | To enable a domestic bank to manage foreign currency transactions with a correspondent bank. | To track, reconcile, and monitor Nostro account activity for operational accuracy. | To describe the account relationship of another bank in multi-bank payment chains. |

| Existence | Exists physically in the domestic bank’s books. | Exists physically in the foreign correspondent bank’s books. | Exists internally in the domestic bank’s systems (not an actual account). | Conceptual reference used in communication (not an actual account). |

| Ownership | Owned by the foreign bank but maintained in the domestic bank’s ledger. | Owned by the domestic bank but maintained in the foreign correspondent bank’s ledger. | Owned by the domestic bank; mirrors the Nostro account’s activity. | Not owned by any specific bank; refers to a third-party bank’s account relationship. |

| Operational Role | Facilitates foreign banks’ access to local clearing systems and currency management. | Enables domestic banks to conduct cross-border transactions in foreign currency. | Provides a real-time, internal ledger to ensure the Nostro account’s accuracy and track balances. | Serves as a reference for describing relationships between banks in payment instructions or reports. |

| Currency Denomination | Denominated in the domestic bank’s local currency. | Denominated in the foreign correspondent bank’s currency. | Denominated in the same currency as the Nostro account it mirrors. | Can reference accounts in any currency. |

| Reconciliation | The domestic bank reconciles transactions with the foreign bank that owns the Vostro account. | The domestic bank reconciles transactions with the foreign bank holding the Nostro account. | Used by the domestic bank to reconcile Nostro account balances and detect discrepancies. | No reconciliation needed; used only for communication and referencing. |

| Example of Usage | A UK bank holds a GBP Vostro account for the US bank to process transactions in GBP. | A US bank holds a GBP Nostro account with a UK bank to manage GBP transactions. | The US bank maintains a Mirror Nostro account in its internal ledger to track its GBP Nostro account held with the UK bank. | A German bank refers to the US bank’s Nostro account with a UK bank as “their account with them” for payment processing. |

| Financial Role | Represents a liability for the domestic bank (because it holds funds on behalf of the foreign bank). | Represents an asset for the domestic bank (because it has funds deposited with the foreign bank). | Not a financial account; purely operational for reconciliation purposes. | Not a financial account; purely conceptual for reference. |

| SWIFT Involvement | Transactions often involve SWIFT messages like MT103 (customer credit transfer) or MT202 (bank-to-bank transfer). | Transactions are tracked using SWIFT messages like MT900 (debit advice) and MT910 (credit advice). | Updates are typically automated through SWIFT messages (e.g., MT950, MT900, and MT910). | Commonly referenced in SWIFT messages for multi-bank transactions, but not directly involved in account operations. |

| Primary Stakeholders | Foreign banks needing access to the domestic bank’s services. | Domestic banks managing funds in a foreign country through a correspondent relationship. | Domestic banks managing internal operational accuracy for their Nostro accounts. | Intermediary banks or banks involved in multi-bank payment chains. |

How These Accounts Interact

In international banking, Nostro and Vostro accounts are two sides of the same coin.

A Single Physical Account can be called a Vostro or Nostro or Loro Account based on the perspective lens that we use to see the account. The Mirror Nostro is the reflection of the same physical account.

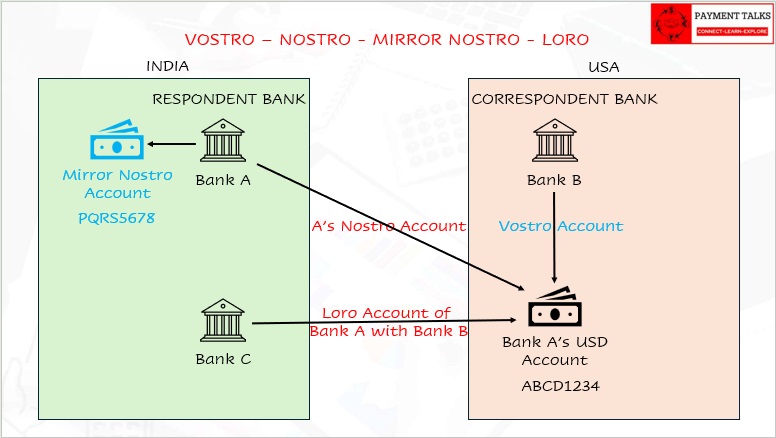

Scenario: Customer A of Bank A holding an account in INR, in India wants to send a payment to his son in the United States to pay the college fees in USD. The Son, B, has a USD account in the United States with Bank B. Customer A initiates the payment. Now the onus is on Bank A to settle this payment and make sure the USD is reached to the son. Assume Bank A does not have a presence in the United States.

To honour such payments in USD to the United States, the Bank needs a Correspondent Bank that can process these payments on their behalf. Bank A opens an Account in USD with Bank B. Let’s say, the physical Account Number of Bank A in Bank B is “ABCD1234” in Bank B’s books. To track, monitor, and reconcile this account in Bank B, Bank A will open a mirror account in Bank A’s books. Let’s say, this mirror account number is “PQRS5678” in Bank A’s books and represents the actual account present in Bank B.

Bank A’s perspective

- From Bank A’s perspective, its account “ABCD1234” with Bank B in a foreign country is called a Nostro account.

- For tracking and bookkeeping, this account may be represented as “PQRS5678” in Bank A’s internal systems. Other than Bank A, no entity would make sense of the Account Number PQRS5678. This is also called a Nostro Mirror Account.

- Simply put, PQRS5678 (maintained in USD at Bank A) is the Mirror Account of the actual account ABCD1234 (maintained in USD at Bank B).

Bank B’s Perspective:

- From Bank B’s perspective, the actual account ABCD1234 is a Vostro account. It would not understand the account number PQRS5678.

Bank C’s Perspective:

Loro accounts come into play when a third bank (e.g., Bank C in India) is involved in a transaction. Bank C wants to send a USD payment to the United States. Bank C does not have any USD correspondence, and it intends to use the Bank A account with Bank B. Bank C would settle domestically with Bank A in INR so that Bank A can use its account to settle the USD payment for Bank C.

- From Bank C’s perspective, it would use the Loro Account of Bank A with Bank B to settle the USD transactions of its own customers.

Working Example with Accounting Entries

Let’s continue the same example to illustrate how Nostro and Vostro accounts operate, including the accounting entries:

Scenario 1:

- Bank A in India has a customer (Customer A) who wants to send USD 1,000 to a recipient (Customer B) in the United States.

- Customer A holds an INR account with Bank A.

- Bank A uses its Nostro account (ABCD1234) in USD with Bank B in the United States to facilitate the transfer.

- Assume the exchange rate is 1 USD = 80 INR, so USD 1,000 is equivalent to 80,000 INR.

Points to be noted and Assumptions

- FX Suspense Account is internal account of Bank where the Currency Conversion happens. It is a Multi-Currency Account.

- At the end of the day, the Bank calculates the FX Profit or Loss in the base currency. The FX deals and Counter Accountings are outside the scope of Payments and handled by the Treasury Department of the Bank.

- We are not considering the FX gains/losses here. We are focusing only on the conceptual clarity of Nostro, Vostro, and Mirror Nostro. We will discuss more on FX gains/losses in future articles where we discuss the Accounting Concepts.

- Accounting can be of many types. We are considering a simple concept here.

Step 1: Processing of the Payment in Bank A

Bank A debits Customer A’s account for INR 80,000 and Credits its Suspense Account.

- Accounting Entry for Bank A:

- Entry 1:

- Debit: Customer A’s Account – INR 80,000

- Credit: Bank’s FX Suspense Account – INR 80,000

- Entry 1:

Bank A converts the INR into USD and sends the payment instruction to Bank B to debit its Nostro Account ABCD1234 to the tune of 1,000 USD.

- Entry 2:

- Debit: Bank’s FX Suspense Account – USD 1,000

- Credit: Nostro Mirror Account (PQRS5678) – USD 1,000

Step 2: Processing of the Payment in Bank B

Bank B credits Customer B’s account with 1,000 USD.

- Accounting Entry for Bank B:

- Debit: Vostro Account (ABCD1234) – 1,000 USD

- Credit: Customer B’s Account – 1,000 USD

Step 3: Reconciliation

The Nostro Mirror Account (PQRS5678) in Bank A and the Vostro Account (ABCD1234) in Bank B (Nostro Account of Bank A) reflect the same transaction but are recorded differently:

- For Bank A, the Nostro Mirror Account shows a Credit of 1,000 USD.

- For Bank B, the Vostro Account shows a corresponding Debit of 1,000 USD.

Please note the Mirror Account shows the inverted entry of the Actual Account. In this case, the actual account is debited in USD, but the mirror account is credited in USD. Note: Only Account Servicing Institution will generate a Debit Credit Notification or Statement to the Account Owner for the Account that is on its books (VOSTRO Account). For a Nostro Account, there will be no Debit Credit Notification or Statements.

Scenario 2:

Extending Scenario 1, we will try to understand in detail. We will look at this scenario to clarify the concept more.

- Bank C in India has a customer (Customer C) who wants to send USD 2000 to a recipient (Customer D) having an account in Bank D in the United States.

- Customer C holds an INR account with Bank C. Customer D holds a USD account with Bank D. Bank C does not have any Correspondent in the USA to settle USD. Bank C wishes to use the Nostro Account of Bank A with Bank B (which is the Loro Account for Bank C) to settle the USD payment with Bank D.

- Bank C initiates the transaction via Bank A and Bank B to Bank D to credit the USD in Customer D’s Account.

- Assume the exchange rate is 1 USD = 80 INR, so USD 2,000 is equivalent to 1,60,000 INR.

Step 1: Processing of the Payment in Bank C – Payment Initiator

Bank C debits Customer C’s account for INR 1,60,000 by initiating a payment to Bank A. In this example, we assume that Bank C settles INR 1,60,000 via a Local Clearing System to Bank A in India. (Note: There is another option that Bank C can have a USD account with Bank A. This is not a common scenario as Bank C can alternatively open a USD account with any Bank in the USA as its correspondent).

Accounting Entry for Bank C:

Entry 1:

Dr: Customer C’s Account – 1,60,000 INR

Cr: Bank A (via the Local Clearing) – 1,60,000 INR

Step 2: Processing of the Payment in Bank A: Local Correspondent of Bank C for USD

Bank A receives the INR funds from Bank C via Local Clearing and then sends the payment instruction to Bank B to debit its Nostro Account ABCD1234 to the tune of 2,000 USD to pass on the funds to Customer D having an account with Bank D.

Accounting Entry for Bank A:

Entry 1:

Dr: Bank C (via the Local Clearing) – 1,60,000 INR

Cr: Bank’s FX Suspense Account – 1,60,000 INR

Bank A converts the INR into USD and sends the payment instruction to Bank B to debit its Nostro Account ABCD1234 to the tune of 2,000 USD.

Entry 2:

Dr: Bank’s FX Suspense Account – USD 2,000

Cr: Nostro Mirror Account (PQRS5678) – USD 2,000

Step 3: Processing of the Payment in Bank B: Correspondent Bank of Bank A for USD

Bank B receives the instruction from Bank A to pass the funds to Bank D in the USA. Since Bank B and Bank D are located in the USA, Bank B settles the USD amount via Local Clearing in the USA.

Accounting Entry for Bank B:

Dr: Vostro Account (ABCD1234) – 2,000 USD

Cr: Bank D (via Local Clearing) – 2,000 USD

Step 4: Processing of the Payment in Bank D: Creditor Agent or Holder of Customer D’s Account

Bank D receives the funds via Local Clearing and credits Customer D’s Account in its Books.

Accounting Entry for Bank D:

Dr: Bank B (via Local Clearing) – 2,000 USD

Cr: Customer D’s Account – 2,000 USD

Finally, Customer D’s account is Credited ending the Payment Chain.

Note: We will look at the Local Clearing and Settlement process and the accounting entries in the next articles and videos.

Advantages of Nostro, Mirror Nostro, Vostro, and Loro Accounts

- Efficient International Transactions: These accounts streamline cross-border payments and reduce settlement times.

- Liquidity Management: Banks can manage their foreign currency reserves more effectively.

- Support for Trade Finance: Simplifies the financing of international trade by providing mechanisms for currency exchange and payment settlement.

- Transparency and Record Keeping: Maintains clear records of international financial dealings, aiding compliance and audits.

Challenges and Risks

- Currency Fluctuations: Foreign exchange rate volatility can affect the balances in Nostro accounts.

- Operational Costs: Maintaining and reconciling multiple accounts in different currencies is resource intensive.

- Regulatory Compliance: Banks must adhere to stringent anti-money laundering (AML) and know-your-customer (KYC) regulations.

- De-Risking: Some banks terminate relationships with higher-risk regions, limiting access to Nostro and Vostro facilities.

Modern Trends and Technological Advancements

- SWIFT gpi: Enhances transparency and tracking of cross-border payments, improving the utility of Nostro accounts.

- Blockchain and Digital Currencies:

- Platforms like Ripple aim to replace traditional Nostro/Vostro setups with real-time settlements.

- Central Bank Digital Currencies (CBDCs) could reduce dependency on correspondent banking.

- Automation and AI: Streamline account reconciliation, reducing operational costs and errors.

Conclusion

Understanding the roles of Nostro, Vostro, Mirror Nostro, and Loro accounts is essential for grasping the intricacies of correspondent banking and international payment systems. Each account serves a distinct purpose within the global financial ecosystem. From an accounting perspective, these accounts illustrate the movement of funds across borders, where entries such as debits, credits, and reconciliations ensure transparency and accuracy in financial reporting. The accounting intricacies reinforce the importance of operational efficiency, compliance, and risk management in the context of global banking.

As the world moves toward faster, more automated payment systems with standards like ISO 20022, the foundational principles of correspondent banking and the roles of these accounts remain indispensable. By understanding their functions and accounting processes, banks and financial institutions can better navigate the complexities of international payments and foster seamless global trade and commerce.