Introduction

After understanding who can initiate a PAIN.001 and why, the next natural question is:

How is a PAIN.001 message actually built?

Because in payment systems, structure is everything.

Banks don’t process “intent”.

They process hierarchy, grouping, and repetition.

This article focuses on the big picture structure of PAIN.001:

- The architectural layers

- How payments are grouped

- How single vs bulk is formed

- How this compares with legacy MT101

We will not go field-by-field here.

That deep dive comes in the next article.

Cardinality in ISO 20022

Cardinality is one of those ISO 20022 concepts that looks theoretical at first—but once you understand it, it becomes the key to reading, building, and validating messages correctly (especially PAIN.001)

What Is Cardinality? (Plain English)

In ISO 20022, cardinality defines how many times a data element is allowed to appear in a message.

In simple terms, cardinality answers:

“How many times can this field occur?”

It controls:

- Whether a field is mandatory or optional

- Whether it can appear once or multiple times

Cardinality Syntax (How ISO Writes It)

ISO 20022 expresses cardinality using this format:

[min..max]

Common patterns

| Cardinality | Meaning |

| [1..1] | Mandatory, must appear exactly once |

| [0..1] | Optional, may appear once or not at all |

| [1..n] | Mandatory, can repeat |

| [0..n] | Optional, can repeat |

Rule of thumb

- 0 = optional

- 1 = mandatory

- n = repeatable

Why Cardinality Exists (Why ISO Needs It)

ISO 20022 messages are:

- Machine-validated

- Processed at scale

- Used across many countries and banks

Without cardinality:

- Messages would be ambiguous

- Banks wouldn’t know what to expect

- Validation would be inconsistent

So cardinality ensures:

- Predictability

- Automation

- Straight-through processing (STP)

Cardinality vs “Mandatory / Optional” (Important Distinction)

Many people think cardinality only means mandatory vs optional.

That’s only half the story.

Cardinality controls TWO things:

- Is the element required?

- Can it repeat?

Example:

- [1..n] → mandatory and repeatable

- [0..n] → optional and repeatable

This is why cardinality is more powerful than a simple “mandatory” flag.

Cardinality vs Business Rules (Important Difference)

Cardinality is defined by ISO.

But banks may add stricter business rules, for example:

- ISO: [0..1] (optional)

- Bank rule: “Mandatory in our implementation”

So:

- ISO cardinality = structural rule

- Bank rules = implementation rule

Both must be satisfied.

Intuitive analogies to remember it

You can think of cardinality in ISO 20022 using a few simple analogies:

- Restaurant menu analogy

- “You must choose 1 main dish” → 1..1.

- “You may choose 0 or 1 dessert” → 0..1.

- “You must choose at least 1 side, can choose several” → 1..n.

- “You may choose as many toppings as you like, or none” → 0..n.

The Design Philosophy Behind PAIN.001

PAIN.001 belongs to ISO 20022.

ISO 20022 messages are built with one clear principle:

Model the business reality explicitly, not implicitly.

Instead of:

- Flat tags

- Guessing group boundaries

- Order-dependent interpretation

ISO uses:

- Clear layers

- Logical grouping

- Strong validation

- Repeatable blocks

So PAIN.001 is not just an XML file.

It’s actually a mini payment system model inside a message.

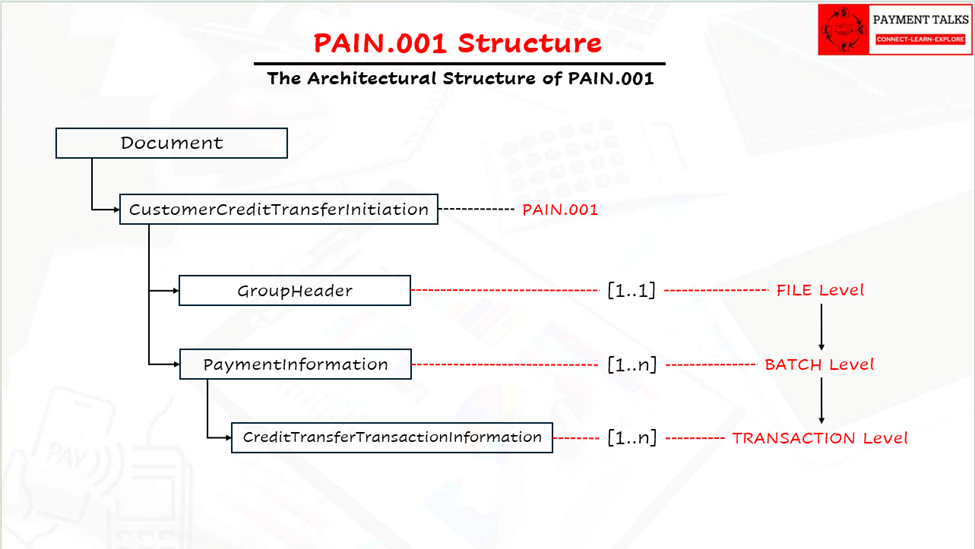

The Architectural Structure of PAIN.001

At the highest level, PAIN.001 follows a 3-layer hierarchy.

Let’s understand what each layer means.

Layer 1 — Group Header (File Level)

Think of this as the envelope of the entire file.

It answers:

- Who created this file?

- When was it created?

- How many payments are inside?

- What is the control sum?

Key idea:

Everything in the file shares this context.

If this layer fails validation → entire file fails.

Layer 2 — Payment Information (Batch Level)

This is the most important structural concept in PAIN.001.

Each Payment Information block represents:

One debit account + one execution context

Inside one batch:

- One debtor

- One debtor account

- One debtor bank

- One execution date

- Many credit transfers allowed

So practically:

One batch = one funding source

If you need:

- Multiple debit accounts

- Different execution dates

You create multiple batches.

Layer 3 — Credit Transfer Transaction (Transaction Level)

This is the actual payment instruction.

This layer is inside the Payment Information that is inside layer 2.

Each block represents:

- One beneficiary

- One amount

- One transfer

So:

One transaction = one payment

If you want 1,000 salary payments → you repeat this block 1,000 times.

How PAIN.001 Naturally Supports Single vs Bulk

Here’s the most beautiful part of PAIN.001:

There is NO special “bulk” message.

Bulk is simply created through repetition of structure.

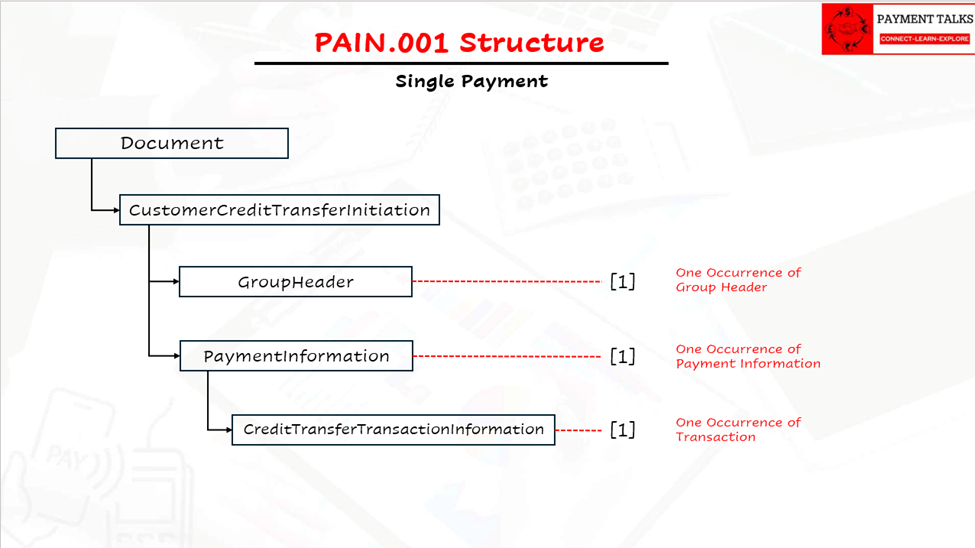

Single Payment (PAIN.001)

Structure:

Meaning:

- One debit

- One credit

Use case:

- Urgent supplier payment

- One-off transfer

The number of transactions in CBPR+ payment usage guidelines is fixed to 1.

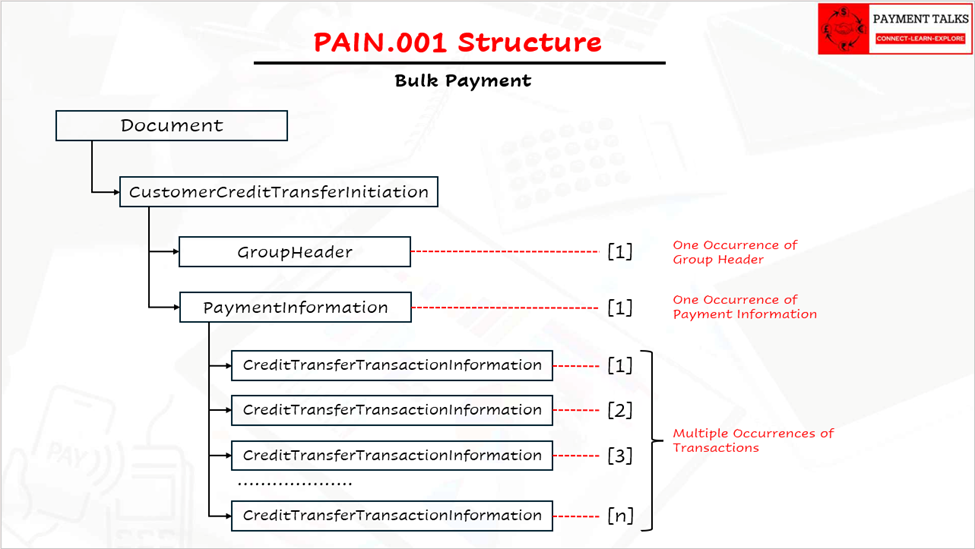

Bulk Payment (PAIN.001)

Structure:

Meaning:

- One debit account

- Many credits

Use case:

- Salaries

- Vendor batches

- Marketplace payouts

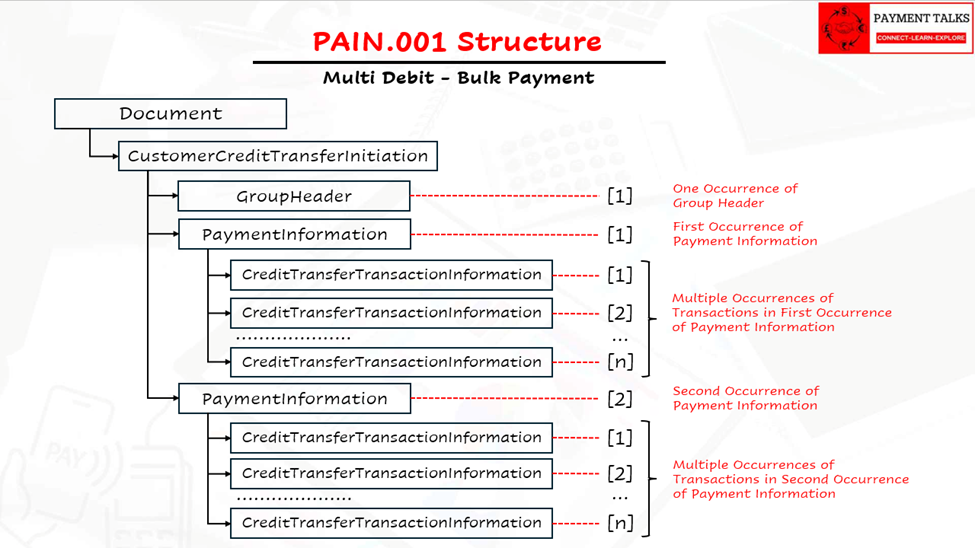

Multi-Debit Bulk

Structure

Meaning:

- Multiple debit accounts

- Multiple bulk groups

MAIN Point

Bulk in PAIN.001 is not a feature.

It’s simply cardinality + hierarchy working together.

This makes the design:

- Cleaner

- Scalable

- Easier to validate

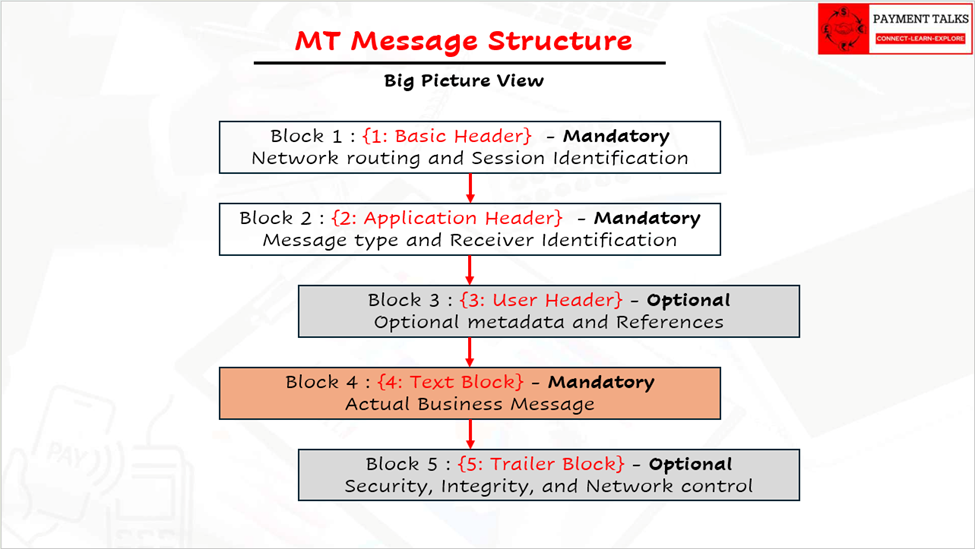

Understanding the 5-Block Structure of SWIFT MT Messages (Including MT101)

Before you even reach the payment details inside an MT101, every SWIFT MT message first passes through a standard envelope.

Think of it like sending a courier package:

- Outside → routing & delivery info

- Inside → business documents

Similarly, SWIFT MT messages separate network delivery from business content.

All MT messages — whether MT101, MT103, MT202, MT940, etc. — follow the same universal structure defined by SWIFT.

Big Picture View

These are called the 5 blocks.

Only Block 4 contains business/payment data.

The rest exist for routing, control, and security.

Simply Put:

“Block 4 = Business Logic. Everything else = Delivery Infrastructure”

Block 1 — Basic Header Block

Purpose – Network routing and session identification

This block tells SWIFT:

- Who sent the message

- Which session it belongs to

- How to route it internally

It is purely technical — banks don’t use this for payment decisions.

Example: {1:F01CORPGB2LAXXX0000000000}

Key Characteristics

- Mandatory

- Always present

- No business meaning

- Not visible to corporate users

Simple Analogy

Block 1 = Return address on an envelope

Block 2 — Application Header Block

Purpose – Message type + receiver identification

This tells SWIFT:

- Which bank should receive the message

- What type of message it is (101, 103, etc.)

- Priority

Without this block – SWIFT wouldn’t know where to deliver the message.

Example: {2:I101BANKDEFFXXXXN}

Key Characteristics

- Mandatory

- Network-level only

- No payment data

Simple Analogy

Block 2 = Destination address on envelope

Block 3 — User Header Block (Optional)

Purpose – Optional metadata and references

Banks and corporates use this for:

- Tracking IDs

- Service-specific fields

- Regulatory/compliance flags

This block does not affect message structure, only adds metadata.

Example: {3:{108:PAYROLLSEP24}{121:UETR123456789}}

Key Characteristics

- Optional

- Bank/custom use

- Not core payment logic

Simple Analogy

Block 3 = Sticky notes on envelope (tracking labels, phone numbers, etc.)

Block 4 — Text Block (Most Important)

Purpose – Actual business message

This is where:

- Payment instructions

- Accounts

- Amounts

- Beneficiaries

- References

ALL reside.

For MT101 specifically: Sequences A & B are inside Block 4.

Example:

{4:

:20:REF001

:50H:/12345678

ABC LTD

:21:PAY1

:32B:EUR1000,

:59:SUPPLIER

-}

How It Works

Block 4 contains:

- Tags (:20:, :50:, :32B:, etc.)

- Sequences

- Payment instructions

Each MT message type defines, which tags are allowed.

Key Characteristics

- Mandatory

- Business logic lives here

- Parsed by bank systems

- Most important block

Simple Analogy

Block 4 = The actual document inside the envelope

Block 5 — Trailer Block

Purpose – Security, integrity, and network control

This block ensures:

- Message not tampered

- Integrity maintained

- Authentication possible

Example : {5:{CHK:ABC123456789}{MAC:987XYZ}}

Key Characteristics

- Optional but common

- Security-focused

- No business logic

Simple Analogy

Block 5 = Tamper-proof seal on envelope

Putting It All Together

Complete MT Message Example

{1:F01CORPGB2LAXXX0000000000}

{2:I101BANKDEFFXXXXN}

{3:{108:REF123}}

{4:

:20:REF001

:50H:/12345678

ABC LTD

:21:PAY1

:32B:EUR1000,

:59:SUPPLIER

-}

{5:{CHK:ABC123456789}}

Key Takeaway

In every MT message, only Block 4 matters for business processing.

Blocks 1, 2, 3, and 5 exist purely to deliver and protect the message.

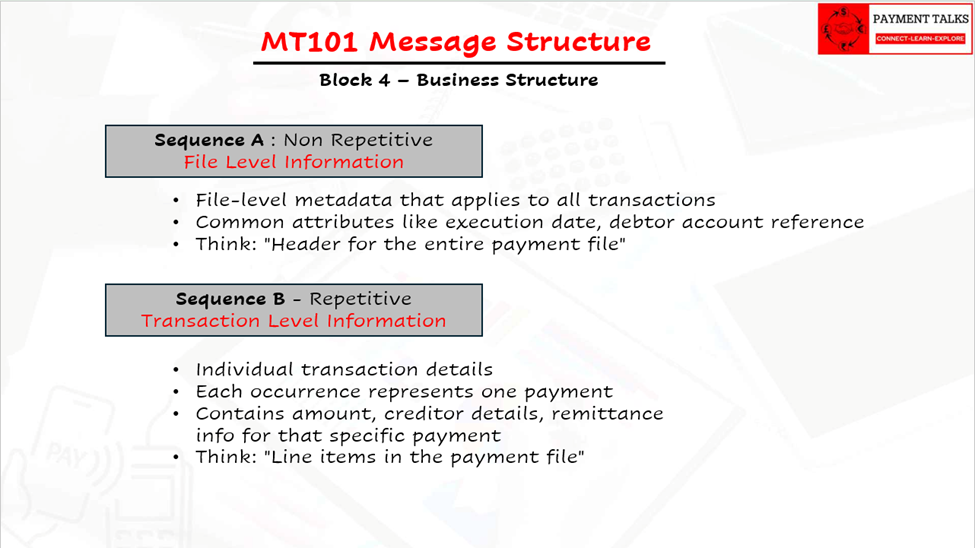

MT101 Structure (Conceptually)

PAIN.001’s predecessor is SWIFT MT101.

But MT101 uses a very different design philosophy.

- Text-based

- Tag-sequence driven

- Flat

- Implicit grouping

Instead of hierarchy, it relies on:

- Repeated tags

- Sequence numbers

- Bank interpretation

There is no explicit:

- File object

- Batch object

- Transaction object

Everything is inferred.

MT101 Block 4 Business Structure

Two Conceptual Levels

Sequence A (Single occurrence)

- File-level metadata that applies to all transactions in the message

- Contains common attributes like execution date, debtor account reference

- Think: “Header for the entire payment file”

Sequence B (Multiple occurrences)

- Individual transaction details

- Each occurrence represents one payment

- Contains amount, creditor details, remittance info for that specific payment

- Think: “Line items in the payment file”

Key Characteristics

- Fixed hierarchy: Always Sequence A first, then repeating Sequence B

- No Explicit delimiters: Sequence B repetition is just appearance of Tag that belongs to next iteration.

- Shared attributes: All Sequence B transactions inherit Sequence A settings unless overridden

- Atomic message: One complete MT101 = one business instruction set

MT101 = One File Header (Seq A) + Multiple Transactions (Seq B)

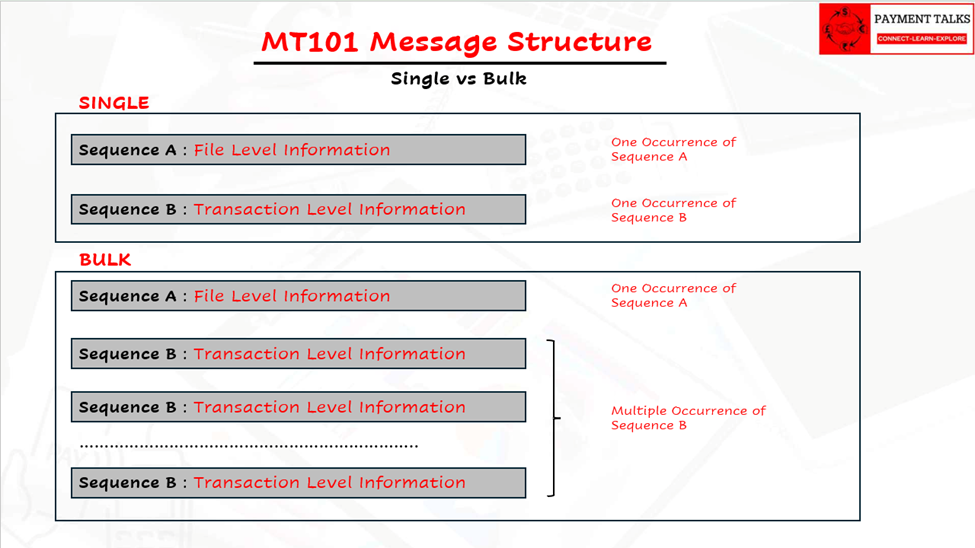

Single Vs Bulk Structure of MT101

Structure

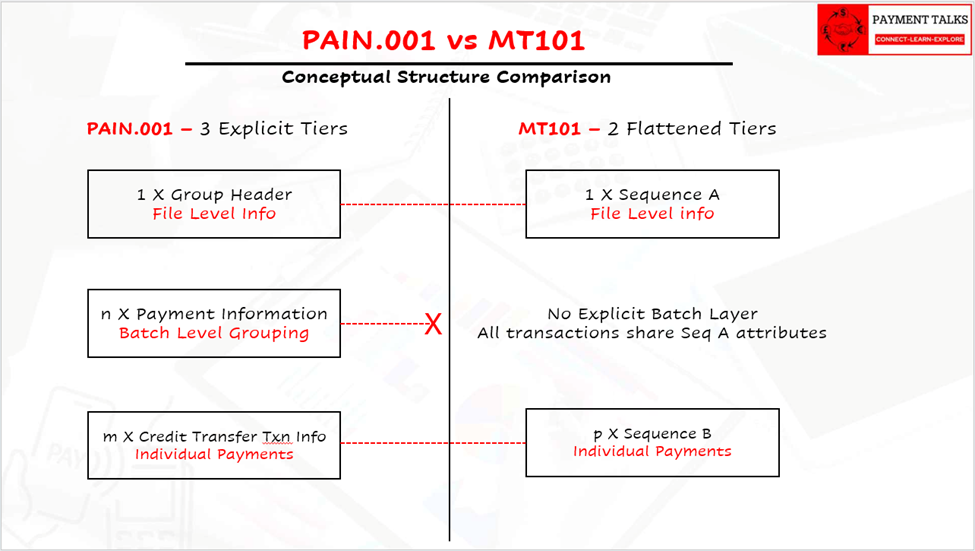

Conceptual Structure Comparison (PAIN.001 vs MT101)

Core Conceptual Differences

1. Hierarchy Depth: 3 levels vs 2 levels

- PAIN.001: File → Batch → Transaction

- MT101: File → Transaction (batch implied)

PAIN.001 explicitly separates:

- File controls (GrpHdr)

- Batch grouping (PmtInf)

- Transaction details (CdtTrfTxInf)

MT101 collapses batch-level info into Sequence A, forcing all transactions to share the same execution date and debtor account.

2. Repetition Pattern

- PAIN.001: 1 GrpHdr (Never Repeats) → n * PmtInf → m * CdtTrfTxInf (in each PmtInf)

- MT101: 1 Sequence A (Never Repeats) → n * Sequence B

3. Batch Flexibility

- MT101 limitation:

Sequence A attributes apply to ALL Sequence B:

- Single execution date

- Single debtor account

- Single service level

- PAIN.001 capability:

Each PmtInf can have:

- Different execution dates

- Different debtor accounts

- Different booking preferences

Structural Difference at a Glance

| Aspect | PAIN.001 | MT101 |

| Format | XML | Text |

| Structure | Hierarchical | Flat |

| Batch concept | Explicit | Implicit |

| Bulk handling | Native | Workaround |

| Validation | Strong (schema-based) | Weaker |

| Machine readability | High | Medium |

| Modern scalability | Excellent | Limited |

Business Scenarios Comparison

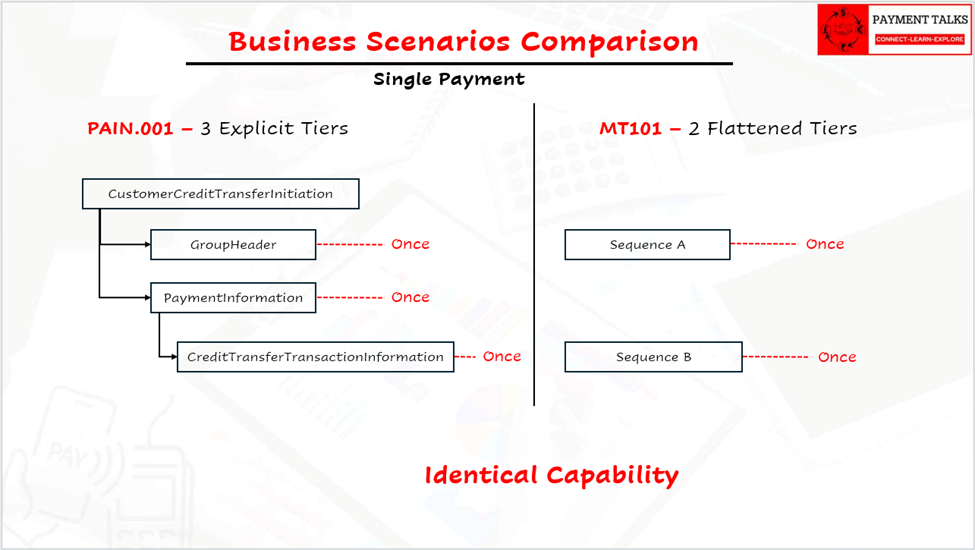

1) Single Payment (Identical capability)

- PAIN.001: 1 GrpHdr + 1 PmtInf + 1 CdtTrfTxInf

- MT101: 1 Seq A + 1 Seq B

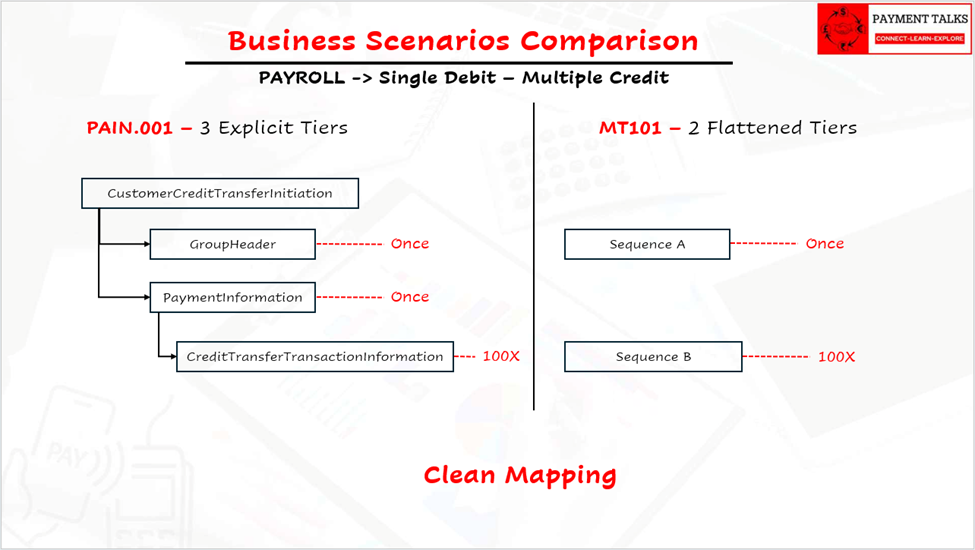

2) Payroll Only (Clean mapping)

- PAIN.001: 1 GrpHdr + 1 PmtInf + 100 CdtTrfTxInf

- MT101: 1 Seq A + 100 Seq B

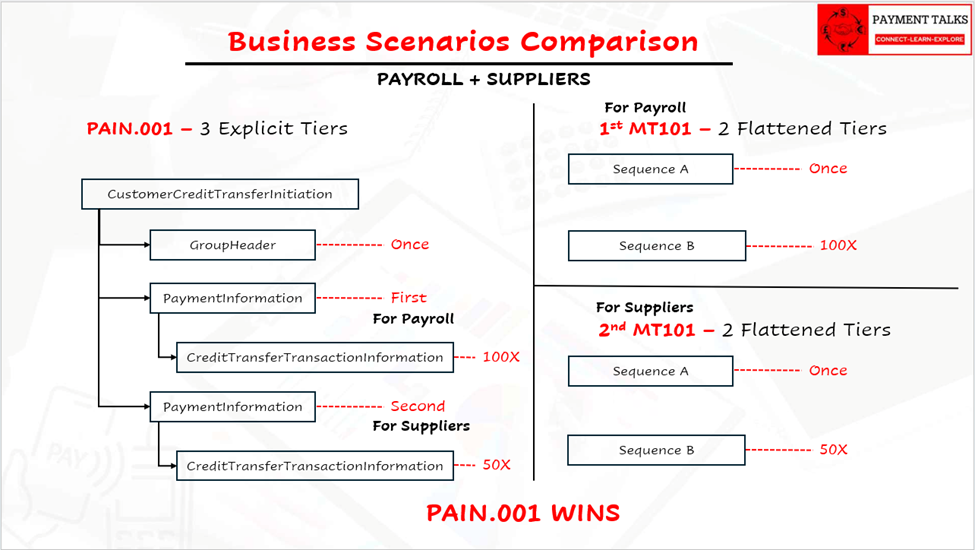

3) Payroll + Suppliers (PAIN.001 wins)

- PAIN.001: ONE FILE

- 1 GrpHdr + 1st PmtInf (Payroll Account, 1st Jan) + 100 salary Beneficiaries (under 1st PmtInf) + 2nd PmtInf (Suppliers Account, 5th Jan) + 50 supplier Beneficiaries (under 2nd PmtInf)

- MT101: TWO SEPARATE MESSAGES

- Msg 1: Seq A (Payroll date/account) + 100 Seq B

- Msg 2: Seq A (Supplier date/account) + 50 Seq B

The “Missing Layer” Problem

MT101 never had an explicit batch layer because:

- All transactions shared Sequence A attributes

- Banks handled operational grouping behind the scenes

- SWIFT FIN treated each MT101 as one atomic message

PAIN.001 explicitly models what MT101 users always wanted.

“I want to send payroll AND suppliers in one file, but keep them operationally separate for tracking/execution”

Key Observation

- Convert MT101 internally → into ISO-like hierarchical structures anyway

Which tells us:

- PAIN.001 reflects how banks actually process payments today.

MT101 reflects how payments were processed decade ago.

Final Takeaway

MT101 is structurally flat and interpretation-based, while PAIN.001 is hierarchical and explicitly modeled.

MT101 says: “Here are instructions — figure them out.”

PAIN.001 says: “Here is the exact structure — process it.”

MT101 thinks: “One header → Many transactions”

PAIN.001 thinks: “One file → Many batches → Many transactions”

That’s the real evolution from MT to ISO 20022.

Why Structure Matters Before Going Field-Level

Understanding structure first is critical because:

Without structure:

- Fields feel random

- Validation feels confusing

- Bulk logic feels magical

With structure:

- Everything has a place

- Everything has a purpose

Fields only make sense inside their layer.