What Is PAIN.001?

PAIN.001 (Customer Credit Transfer Initiation) is an ISO 20022 message used by a customer (typically a corporate or institution) to instruct its bank to make one or more credit transfers.

In simple words:

- PAIN.001 is a digital payment instruction file sent by a customer to a bank.

- PAIN.001 does not move money by itself.

- PAIN.001 initiates the payment process inside the bank.

- PAIN.001 is always customer-facing, never interbank.

Why PAIN.001 Exists (Business Rationale)

The Core Business Problem

Corporates need to:

- Pay employees

- Pay suppliers

- Make treasury transfers

- Do this in bulk, securely, and automatically

Before PAIN.001:

- Every bank had its own format

- Corporates built multiple integrations

- Data quality was poor

- Reconciliation was manual

The ISO 20022 Solution

PAIN.001 solves this by providing:

- A single global format

- Structured data instead of free text

- Rich compliance & remittance information

- Support for bulk and complex scenarios

What PAIN.001 Is Used For (Use Cases)

PAIN.001 is used for:

- Salary payments

- Supplier payments

- Vendor settlements

- Intercompany transfers

- Cross-border payments

- Marketplace payouts

- Treasury payments (non-SWIFT channel)

It supports:

- Single payment

- Bulk payments

- Multiple currencies

- Domestic & cross-border

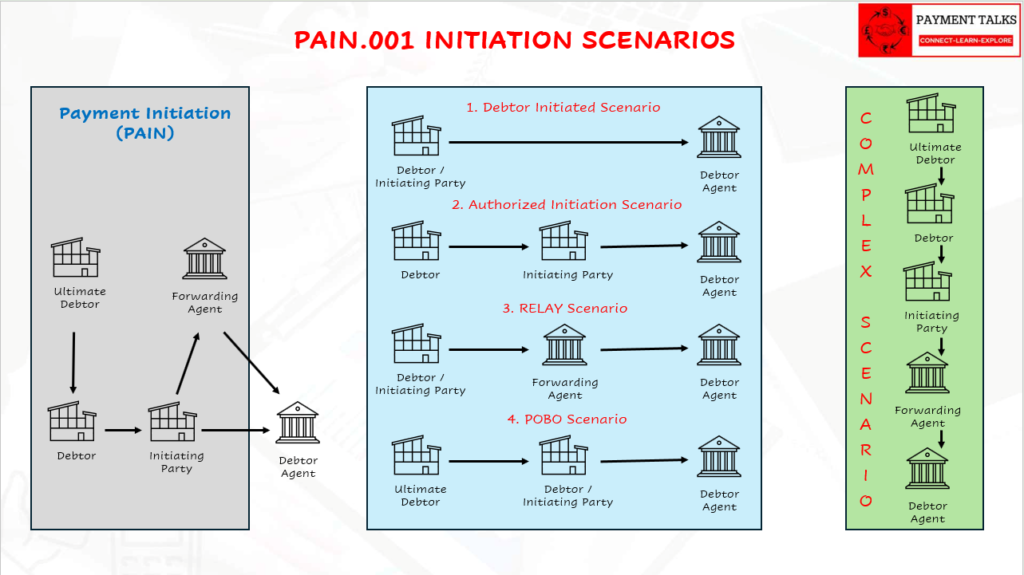

PAIN.001 Initiation Flow Scenarios

PAIN.001 is often introduced as “the ISO 20022 customer credit transfer initiation message”.

While technically correct, that description hides what makes PAIN.001 truly powerful.

PAIN.001 is not just about sending money.

It is about clearly expressing authority, responsibility, and intent in a structured way.

ISO 20022 deliberately separates:

- Who is allowed to initiate a payment

- Whose account is debited

- Who is the economic owner of the payment

- Who may simply forward the instruction

This separation gives rise to distinct PAIN.001 initiation scenarios, all of which are explained below in a consistent and practical way.

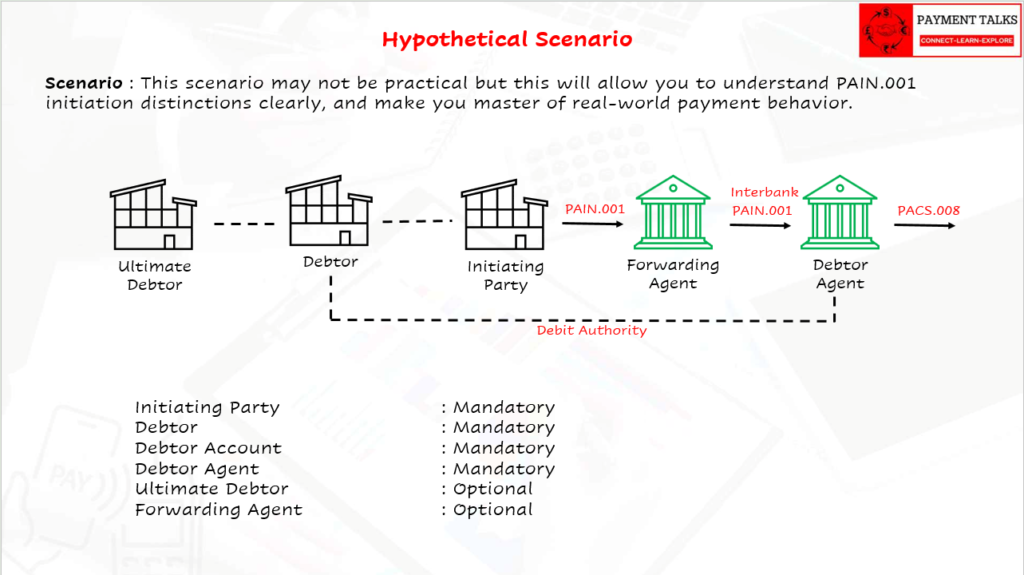

Core ISO 20022 Roles (Foundation)

All PAIN.001 scenarios use the same role model defined by ISO 20022.

Everything that follows depends on understanding these roles correctly.

Core Roles in PAIN.001 (Complete Set)

| Role | What It Really Means |

| Initiating Party (InitgPty) | The party that creates, authorizes, and takes responsibility for the instruction |

| Debtor (Dbtr) | The party whose account is debited |

| Debtor Account (DbtrAcct) | The account from which funds are taken |

| Debtor Agent (DbtrAgt) | The bank servicing the debtor account |

| Ultimate Debtor (UltmtDbtr) | The party for whom the payment is economically made |

| Forwarding Agent (FwdgAgt) | Financial Institution that only forwards the message (not a business role) |

Important Points:

- ISO does not assume these roles must belong to the same legal entity. That assumption is where most misunderstandings start.

- Initiation, forwarding, and execution are separate responsibilities and must never be mixed.

One Rule That Clears 80% of Confusion

Before naming any scenario, always ask below questions:

- Who is allowed to initiate?

- Whose account is debited?

- Is the payment economically for someone else?

- Is any bank only forwarding the message?

The answers uniquely define the scenario.

Every PAIN.001 initiation flow is just a different combination of answers to these.

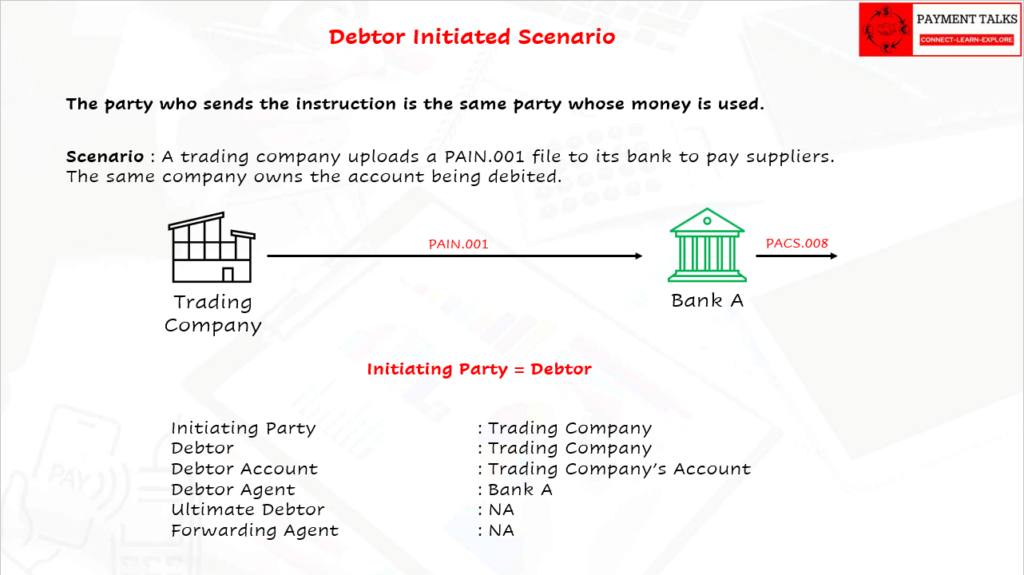

Scenario 1 — Debtor Initiated PAIN.001 (The “Textbook” Case)

What This Scenario Is

This is the simplest and most intuitive model.

The party who sends the instruction is the same party whose money is used.

The initiation can be via ISO Message over networks or via various modes directly using Bank provided Channels.

- Initiating Party = Debtor

Practical Example

A trading company uploads a PAIN.001 file to its bank to pay suppliers.

The same company owns the account being debited.

Role Mapping

| Role | Entity |

| Initiating Party | Trading Company |

| Debtor | Trading Company |

| Debtor Account | Trading Company’s account |

| Debtor Agent | Trading Company’s bank |

| Ultimate Debtor | Not used |

| Forwarding Agent | Not used |

Why This Scenario Exists

Because most payments are still straightforward, and ISO never tries to complicate what doesn’t need complication.

This scenario alone probably covers:

- Salaries

- Local suppliers

- Routine operations

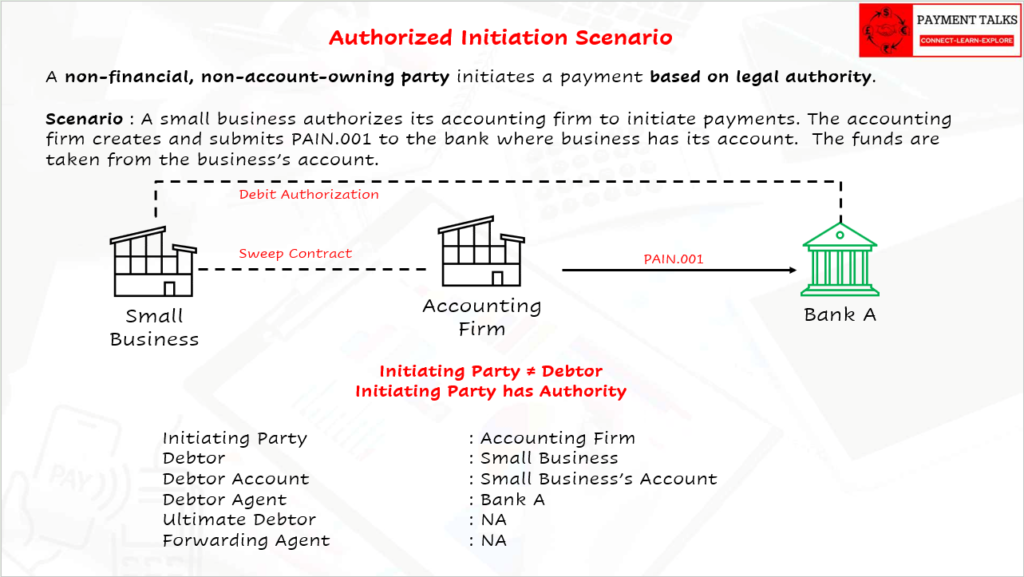

Scenario 2 — Authorized Entity Initiates (Not Debtor, Not Forwarding Agent)

This is the most commonly misunderstood — and most practically important — scenario.

What This Scenario Is

A non-financial, non-account-owning party initiates a payment based on legal authority.

- Initiating Party ≠ Debtor

- Initiating Party has debit authority over Debtor’s Account.

This party:

- May not be a bank

- Is not a forwarding agent

- Has formal authority (mandate, power of attorney)

Practical Example (Very Real World)

Accounting Firm Initiating Payments for a Small Business

- A small business authorizes its accountant to initiate payments

- The accountant creates and submits PAIN.001

- The business’s account is debited

Role Mapping

| Role | Entity |

| Initiating Party | Accounting Firm |

| Debtor | Small Business |

| Debtor Account | Small Business account |

| Debtor Agent | Small Business’s bank |

| Ultimate Debtor | Not used |

| Forwarding Agent | Not used |

The Accounting Firm:

- Is not a forwarding agent

- Is not paying

- Is initiating with Debit authority

Why This Scenario Exists

Because the party allowed to request a payment is not always the account owner.

Subtle but important note:

Banks often validate authority agreements or Tripartite agreements behind the scenes for this model — even though ISO messages don’t show contracts.

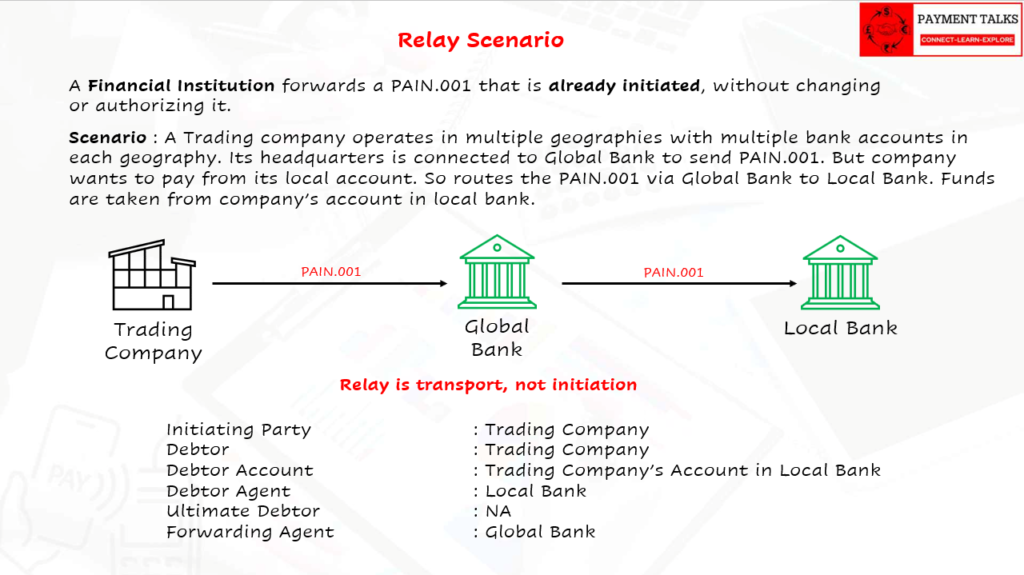

Scenario 3 — Relay Scenario (Forwarding Agent)

Relay is often talked about — and just as often misused.

What This Scenario Is

A Financial Institution forwards a PAIN.001 that is already initiated, without changing or authorizing it.

- Relay is transport, not initiation.

Key ISO Rules

- Forwarding Agent must be a Financial Institution (that’s why PAIN.001 is called Interbank PAIN.001)

- Forwarding Agent never initiates

- Business content must not change

- Does not initiate the payment

- Does not own the funds

- Does not decide the payment

- Does not change the payment details

- Acts like a secure courier

Think of it as:

“I am just delivering the payment order to the bank that will execute it.”

Simple Practical Example

Trading Company with One Connectivity Bank

- The company holds its account with Local Bank

- It connects technically only to Global Bank

- Global Bank forwards PAIN.001 to Local Bank

Role Mapping

| Role | Entity |

| Initiating Party | Trading Company |

| Debtor | Trading Company |

| Debtor Account | Account at Local Bank |

| Debtor Agent | Local Bank |

| Forwarding Agent | Global Bank (FI) |

| Ultimate Debtor | Not used |

Why This Scenario Exists

Key insight

Relay solves connectivity, not authority.

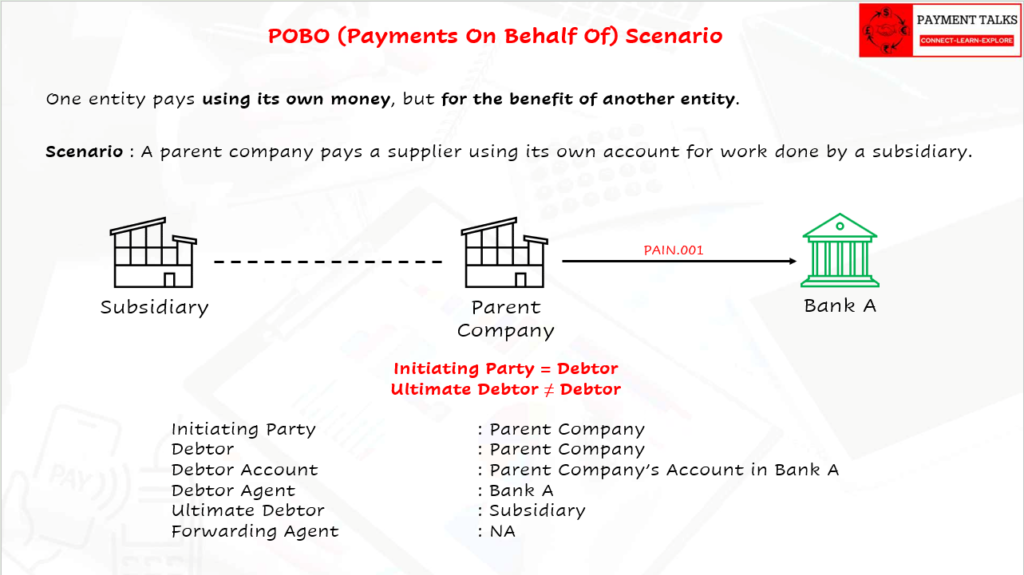

Scenario 4 — POBO (Payments On Behalf Of)

This is the most business-rich scenario.

What This Scenario Is

One entity pays using its own money, but for the benefit of another entity.

This is where Ultimate Debtor becomes essential.

- Initiating Party = Debtor

- Ultimate Debtor ≠ Debtor

Practical Example

A parent company pays a supplier using its own account for work done by a subsidiary.

Role Mapping

| Role | Entity |

| Initiating Party | Parent Company |

| Debtor | Parent Company |

| Debtor Account | Parent Company account |

| Debtor Agent | Parent Company’s bank |

| Ultimate Debtor | Subsidiary |

| Forwarding Agent | Not used |

Simple Analogy (POBO)

Imagine:

- You pay your child’s school fees

- Using your bank account

- But school records say:

“Paid by parent on behalf of child”. That’s POBO.

Why Ultimate Debtor Is Critical

It explains:

- Economic ownership

- Audit responsibility

- Regulatory and tax interpretation

Without Ultimate Debtor, POBO payments look like unexplained third-party payments.

Conclusion

PAIN.001 initiation scenarios exist because authority, money, connectivity, and economic ownership do not always sit with the same party.

- Authority-based initiation separates permission from ownership

- Relay separates connectivity from responsibility

- POBO separates economic ownership from execution

Once these distinctions are clear, PAIN.001 stops being “just an XML message” and becomes a precise model of real-world payment behavior.

Final Thought

If someone can clearly explain all four scenarios with role mappings, they don’t just understand PAIN.001 — they understand how modern payment ecosystems are designed to work without ambiguity or risk.