Introduction

Payments are the lifeblood of the banking system. Every time money moves—from a customer paying a bill, a company running payroll, or a bank settling cross-border trades—there is a carefully orchestrated series of steps that ensure funds are transferred accurately, securely, and in compliance with regulations.

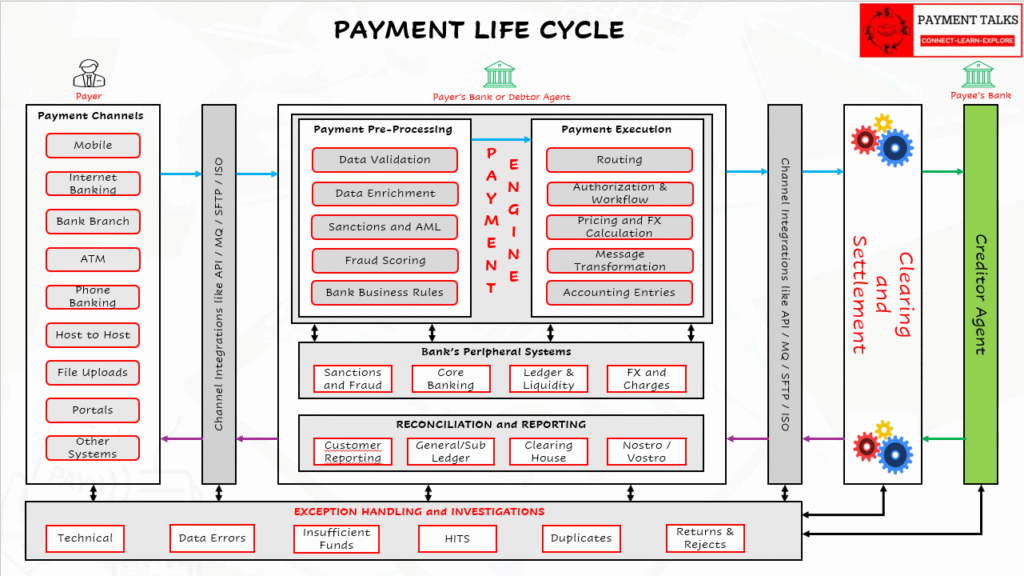

Behind the scenes, a single payment journey involves multiple systems, financial institutions, clearing mechanisms, and control points. Each stage has its own rules, risks, and reporting obligations, and together they form what is known as the Payment Transaction Life Cycle.

Understanding this life cycle is critical not only for bankers and payment operations teams, but also for corporates, fintechs, regulators, and technologists building the infrastructure of modern finance. A clear view of the end-to-end flow helps organisations:

- Ensure payments reach beneficiaries efficiently and safely.

- Comply with regulatory requirements such as AML, sanctions, and reporting.

- Manage operational and liquidity risks.

- Improve customer experience through transparency and speed.

In this article, we break down the payment life cycle into five key stages—Payment Initiation, Payment Processing, Clearing & Settlement, Reconciliation & Reporting, and Exception Handling & Investigation. Each stage is explained in detail, with examples, operational considerations, and practical controls that banks and businesses can apply.

Payment Initiation

What it is: the payer (individual or corporate) creates the instruction that requests money move from one account to another. This is the customer-facing starting point.

Channels & examples

- Retail: mobile app, online banking, branch teller, ATM, phone-banking.

- Corporate: host-to-host (SFTP/API), file upload (e.g., bulk PAIN.001 ISO 20022 files), treasury portals, ERP integrations.

- Alternate rails: card networks (card authorization/settlement flow is different), direct debits, standing orders, instant pay apps.

Key data captured

- Debtor (Payer) Details: Account number/IBAN, Account currency

- Creditor/Beneficiary (Payee) Details: Account number/IBAN, Bank Identifier such as BIC/LEI/Local Bank Code

- Payment Details: Amount and Currency, Value date or Requested execution date

- Charge bearer: OUR / SHA / BEN or bank’s charge policy (useful in Cross Border)

- Other Key Details: Remittance information (invoice references) and instruction-level metadata (urgent flag, bulk/batch, purpose, etc.,)

Customer Authentication & Authorisation

- Retail: Strong Customer Authentication (SCA) – OTP, biometrics, hardware tokens.

- Corporate controls: multi-signatory flows (maker-checker), approval workflows in treasury systems, delegated authorisation.

- Cards: Card/merchant flows include pre-authorizations and holds (this card authorization step different from bank transfer).

Preliminary checks at initiation

- Syntax and format validation (IBAN, field lengths).

- Availability of funds / holds or pre-authorisations (some systems place a temporary hold).

- Basic fraud indicators (velocity checks, unusual payee).

- KYC/Account status checks (is the account active / blocked?).

What the bank systems do next

- Accept and queue the instruction for processing, or return it to the originator with an error code if validation fails.

- For bulk files, validate file structure (e.g., PAIN.001 schema), signatory/cryptographic checks, and per-row validation.

Example: a CFO uploads a bulk file (pain.001) for USD payments. The bank’s front-end validates file format, checks signatories, and confirms that the debit accounts have sufficient balances. The file then proceeds to the bank’s payment processing engine.

Payment Processing

What it is: the bank’s internal engine takes the instruction and turns it into a settled movement of value — validating, enriching, authorising, booking, and preparing the message for interbank clearing.

This is the meat of bank-side work and typically decomposes into several sub-steps:

A. Validation & enrichment

- Business rules & data validation: check account status, currency permissions, IBAN/BIC verification, and daily or per-transaction limits.

- Sanctions & AML screening: name and transaction screening against watchlists and behavioural models. Hits route for investigation.

- Fraud scoring: device fingerprinting, velocity checks, anomaly detection.

- Enrichment: append Standard Settlement Instructions (SSIs), BIC lookup, correspondent chain, or additional remittance details so the payment is routable with minimal manual intervention.

The above steps are part of Payment Pre-Processing. The next steps are part of Payment Execution.

Pre-processing refers to all the validation, enrichment, and compliance checks that a payment instruction undergoes before it is accepted by the payment processing engine for routing and settlement.

It ensures the payment is complete, compliant, and ready to move through internal systems or external clearing networks. Think of it as a “quality check” or “readiness gate” that every payment must pass. It bridges the gap between Payment Initiation and Payment Execution, ensuring that what enters the payment engine is accurate, compliant, and ready for settlement.

The next steps are part of Payment Execution.

Note: Payment Pre-Processing and Payment Execution together are part of Payment Processing Step.

B. Routing

- Determines the optimal path the payment should take to reach the beneficiary bank.

- Factors include:

- Payment scheme availability: ACH, RTGS, Instant, Cross-border SWIFT, or proprietary networks.

- Cut-off times: ensure payments meet same-day or priority deadlines.

- Cost vs. speed trade-off: banks may prefer lower-cost ACH for non-urgent payments, or RTGS for high-value and urgent ones.

- Correspondent banking chains: for cross-border payments, select the right nostro/vostro or intermediary bank with valid currency accounts.

- Network rules & compliance: ensure routing complies with scheme-specific rules (e.g., TARGET2 in Europe, Fedwire in the US, FPS in the UK).

- Routing engines often use decision trees, rules, or AI-driven optimizers to select the path dynamically.

- Example: A USD payment from a European bank to Asia may route via its New York correspondent before reaching the beneficiary bank in Asia via its USD nostro.

C. Authorization and workflow

- Retail: final OTP or SCA call/confirmation.

- Corporate: multi-level approvals, maker-checker, or exception escalations.

- High-value/manual review: operations or compliance sign-off if rules trigger.

D. Pricing and FX (if applicable)

- Charge calculation: apply fees (flat, percentage, or tiered). Decide who bears the fee (OUR vs SHA vs BEN).

- FX conversion: if payment currency differs, apply exchange rate and book FX gain/loss. Display exchange rate to customer where required.

E. Accounting / Booking (double-entry basics)

At this point the bank records ledger entries for both the customer debit and the bank’s settlement movement. Two common patterns:

Case 1 — Fees charged on top of payment (Debtor bears fees / OUR):

- Debit: Customer deposit account — $1,005 (payment $1,000 + fee $5)

- Credit: Settlement / Nostro funding account — $1,000

- Credit: Fee income (revenue) — $5

Case 2 — Fees deducted from payment proceeds (Fee taken from amount sent):

- Debit: Customer deposit account — $1,000 (customer pays $1,000)

- Credit: Settlement / Nostro funding account — $995 (amount sent onward)

- Credit: Fee income — $5

(Always verify your bank’s posting conventions — some banks use suspense / clearing accounts during processing.)

F. Message transformation & STP

- Format conversion: internal format → interbank format (ISO 20022 PACS08 or PACS09).

- Straight-through processing (STP): automated routing without manual intervention; KPI tracked as STP rate.

- Queueing / cut-off: payments may be queued until bank cut-off for the rail (ACH batches) or sent immediately if RTGS/instant rail.

- GPI Tracker Updates (If applicable): Updating the SWIFT GPI Tracker for Cross Border Payments.

G. Exception handling during processing

- Sanctions hit: held and escalated to compliance.

- Insufficient funds: rejected or queued depending on product.

- Data errors: bounced back to originator with error code and remediation guidance.

Key Metrics for Processing

- STP rate (% of payments auto-processed)

- Routing success rate (payments delivered via first-choice path)

- Processing latency (time from initiation to outbound send)

- Exception volume (manual touchpoints per 1,000 transactions)

Clearing & Settlement

What it is: the interbank exchange of payment instructions (clearing) and the actual transfer of value (settlement). This step determines when and how funds movement become final between banks.

Clearing vs Settlement — the distinction

- Clearing: exchange and possibly netting of payment instructions between institutions or through a clearing house.

- Settlement: the actual transfer of value (funds) — debiting/crediting settlement accounts (central bank money, correspondent nostro accounts, or settlement engines).

Main settlement models

ACH (Automated Clearing House) — deferred net settlement (DNS)

- Low-value retail payments typically batched and netted.

- Settlement occurs at one or more times per day between participating banks.

- Risk: Lower liquidity footprint but exposes participants to intraday risk.

RTGS (Real-Time Gross Settlement)

- Each payment settled individually and immediately in central bank money; used for high-value / time-critical payments.

- Provides legal finality and reduces settlement risk.

Instant / Faster Payment systems

- Near real-time retail rails with immediate credit to beneficiary (customer experience is instant credit).

- Requires 24×7 processing capability and strong fraud controls.

Cross-border / Correspondent Banking

- No single global RTGS for retail payments: banks often route through correspondent/nostro chains or use centralized networks.

- The sender’s bank may debit a local nostro account held at a correspondent, which then credits the beneficiary bank’s account or an intermediary.

- Can involve multiple intermediary banks and FX conversions — increases operational complexity, costs, and failure points.

Note: We will cover all these Settlement methods in detail in future videos.

Typical message exchanges (conceptual)

- The sending bank transmits an interbank payment message (e.g., ISO 20022 PACS08 or PACS09 or equivalent) to the receiving bank or clearing house.

- Clearing/Settlement Operator or Receiving Bank returns status messages and final settlement confirmations -> PACS02 or XSYS messages.

- If there is a problem at the beneficiary bank (wrong account, closed account), a return message is generated (e.g., payment return message such as PACS04 or equivalent).

Settlement finality & risk

- Finality: RTGS and many instant systems provide legal finality — once settled, cannot be unwound easily.

- Liquidity management: banks must maintain sufficient intraday liquidity (central bank facilities, repo lines, intraday overdrafts).

- Failed / stuck settlements: banks manage these via intraday monitoring and sometimes manual intervention or funding.

Example flows — Domestic ACH vs Cross-Border

- Domestic ACH: Bank A batches customer debits at 16:00; clearing house nets positions and instructs central bank settlement at 17:30. Bank A’s net debit is posted — after settlement, beneficiary banks can credit their customers.

- Cross-border: Bank A sends instruction to Correspondent Bank X (nostro). Correspondent debits Bank A’s nostro and credits Bank B’s account, possibly via intermediaries. Confirmation flows back to originator; settlement may be same-day or T+1/T+2 depending on corridors.

KPIs for clearing & settlement

- Settlement finality rate (successful settles vs attempts)

- Liquidity utilisation and intraday liquidity shortfall events

- Time-to-settlement for different corridors (instant vs same-day vs T+1)

Reconciliation & Reporting

What it is: post-settlement, verifying that all ledger entries, settlement messages, and third-party reports line up, and producing the customer and regulatory reports that close the loop.

Types of reconciliation

- Nostro / Vostro reconciliation: match internal expected postings with correspondent statements (MT940, CAMT53 or equivalent).

- Clearing house reconciliation: verify participation reports and net positions provided by the ACH/RTGS operator.

- GL / sub-ledger reconciliation: ensure the general ledger, cash position, and sub-ledgers reconcile to the posted payments.

- Transaction-level match: match settlement references, amounts, and timestamps between internal records and external confirmations.

Suspense & Unmatched items

- Unmatched or partially matched items flow into suspense accounts and are investigated by operations teams.

- Common causes: reference mismatches, rounding differences, intermediary fees, or timing differences.

Customer reporting & notifications

- Real-time notifications: push notifications, SMS, webhooks, or email for successful or failed payments.

- Statements & Advices: CAMT53 (bank statement), CAMT54 (change/advice), and legacy MT940 are used to give customers periodic detail. Corporates frequently use CAMT messages for straight-through reconciliation.

Regulatory & Compliance/Audit reporting

- AML / suspicious activity reporting: transactions flagged by behavior or thresholds are escalated to compliance and, if required, reported to authorities.

- Regulatory reporting: central bank reports, payment statistics, and liquidity reports. Maintain audit trail for controls and compliance.

KPIs and Controls

- STP rate: percentage of payments processed without manual touch.

- Reconciliation lag: time to clear all outstanding mismatches (target often same day or T+1)

- Accuracy of nostro/Vostro matching

- Timeliness of customer notifications

Exception Handling & Investigation

What it is: procedures and workflows to detect, investigate, remediate, and report anomalies, errors, and disputes that arise at any point in the payment life cycle.

Typical exception types

- Technical failures: network outage, message format error, failed translation (MT↔MX conversion).

- Data errors: wrong account number, malformed IBAN, missing required fields.

- Insufficient funds: payment rejected, or queued if allowed.

- Sanctions / compliance hits: payment held and investigated; potential mandatory reporting to authorities.

- Returns & recalls: beneficiary bank returns funds (e.g., closed account), or originator requests a recall.

- Duplicate payments / chargebacks (cards): duplicate instruction detection and remediation.

Investigation workflow

- Detection & alerting: automated monitoring flags the exception (failed settlement, returned message, compliance alert).

- Triage: systems classify severity (fraud risk, financial exposure, customer-impact).

- Root cause analysis: operations/compliance/tech triages message flows, timestamps, intermediary traces, and audit logs.

- Correction & remediation: repair data and repost where appropriate, initiate returns or re-issues, reimburse customers if required.

- Communication: notify affected customers (and counterparties) with clear reason codes and next steps.

- Escalation & reporting: escalate high-risk incidents to compliance/legal, and file regulatory reports if necessary.

Common messages & codes

- Payment Return messages (ISO 20022 return types) carry reason codes that clarify whether a return is due to account closed, incorrect details, or regulatory block. Using standardized ISO reason codes shortens investigation time.

Accounting treatment for exceptions

- Reversal entries, suspense postings, and adjustments are posted depending on root cause. Example: if a payment is returned after booking, book reversing entries to restore the customer balance and correct the settlement account; if fees were taken incorrectly, credit/debit fee income and customer account as needed.

Timelines & SLAs

- Define SLAs for initial response, investigation completion, and customer remediation. E.g., initial triage within 1 business hour for high-severity events; full resolution target depends on regulation and product (often same day to T+2).

Prevention & controls

- Improve STP and data validation at initiation.

- Strong sanctions screening and case management for AML.

- Real-time liquidity monitoring to prevent settlement fails.

- Automated duplicate detection and reconciliation to catch issues earlier.

KPIs for exception handling

- Settlement fails: number and value of failed settlements.

- Exception rate: volume of manual interventions per 1,000 payments.

- Mean time to resolution (MTTR) for exceptions

- Compliance case closure time

- Percentage of exceptions prevented by pre-validation or automated rules

Final summary & practical takeaways

- The payment life cycle is best viewed as five connected stages: Initiation → Processing → Clearing & Settlement → Reconciliation & Reporting → Exception Handling & Investigation.

- Each stage has distinct responsibilities, technical patterns, risks, and KPIs.

- initiation is customer-facing and authentication-heavy.

- processing is validation, enrichment and booking.

- clearing/settlement is where value finality and liquidity play out.

- reconciliation closes the loop and supports reporting and remediation.

- exceptional handling makes sure any issues during payments are handled to closure.

- Robust automation (high STP), strong AML/fraud controls, clear SSIs, and timely reconciliation are the foundation of efficient, low-risk payment operations.

- For cross-border flows expect more intermediaries, longer timelines, and extra FX/compliance complexity — design controls and customer messaging accordingly.