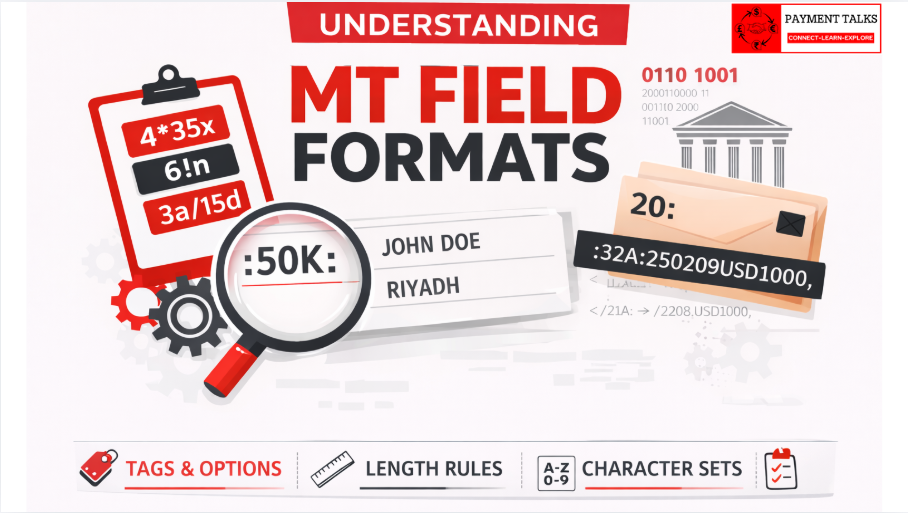

Understanding MT Field Formats | SWIFT MT Message Basics Explained

SWIFT MT messages are often described as “legacy”, yet they continue to power a large part of the global payments ecosystem. At the core of every MT message lies a strict field format language that governs how data must be represented, parsed, validated, and interpreted. Understanding MT field formats is not about memorising syntax. It […]

Understanding MT Field Formats | SWIFT MT Message Basics Explained Read More »